NewDay USA, a lender specializing in loans to veterans and military service members, is addressing rate-driven increases in refinancing by hiring more than 100 workers who are new to the business.

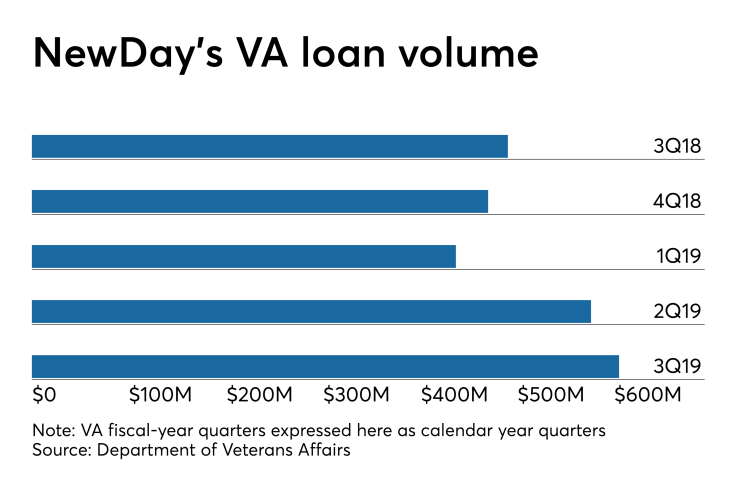

The Fulton, Md.-based nonbank's originations of loans guaranteed by the Department of Veterans Affairs is significantly higher this year. During the quarter ending Sept. 30, its originations of these loans totaled almost $606 million, up more than 23% from a year ago

The new hires at the company, which typically recruits recent graduates from colleges in the area, are being trained at trained at NewDay USA University. The university is the company’s proprietary training facility.

NewDay's prospects are on the upswing both because its volumes are higher and because it recently was able to rectify a concern that had limited pooling options for loans securitized through mortgage-bond insurer Ginnie Mae's program.

Ginnie Mae previously had alleged that NewDay and some other lenders had produced securitized loans with particularly fast prepayments, and set certain limits on the way those lenders could pool loans for securitization in response.

But now that Ginnie finds those companies' refinancing rates are now in line with those of their peers, it has removed those limits. NewDay has been operating without the restrictions since early last month.

One of NewDay's board members, Joseph Murin, is a former Ginnie Mae president and