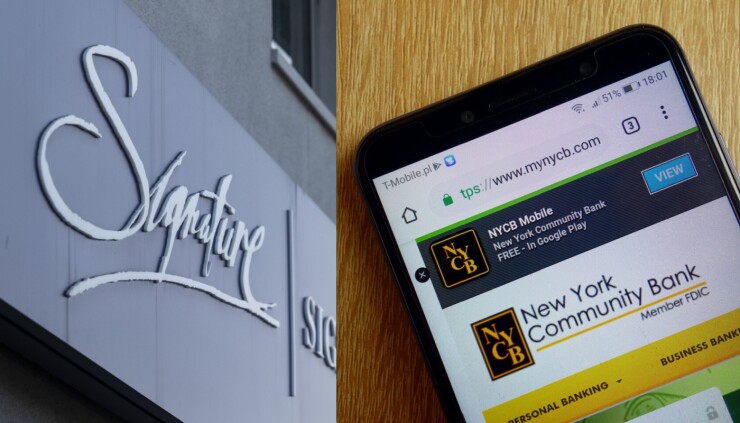

WASHINGTON — New York Community Bancorp's Flagstar Bank subsidiary will purchase substantially all deposits and certain loan portfolios of Signature Bridge Bank, save for its digital-asset banking business and deposits, according to the Federal Deposit Insurance Corp.

Flagstar's offer did not include about $4 billion of deposits related to Signature Bank's digital banking business, which includes — but is not necessarily limited to — its crypto business lines. The FDIC said Sunday it will pay out deposits related to the digital-assets business directly.

The FDIC estimates that the failure of Signature Bank will cost the DIF approximately $2.5 billion, although the agency will determine the exact cost when its receivership has concluded.

The FDIC had no further information about its efforts to

All depositors of the Signature bridge bank formed by the FDIC, except for the ones related to the digital asset banking business, will automatically become depositors of Flagstar Bank. Forty former branches of Signature Bank will operate under Flagstar Bank on Monday.

The FDIC noted that the deposits assumed by Flagstar will be insured "up to the insurance limit."

The purchase includes about $38.4 billion of Signature Bridge Bank's assets, including loans of $12.9 billion purchased at a discount of $2.7 billion. About $60 billion in loans will remain in the receivership, and the FDIC received equity appreciation rights in New York Community Bancorp, common stock with a potential value up to $300 million.

As of Dec. 31, the former Signature Bank had total deposits of $88.6 billion and total assets of $110.4 billion, the FDIC said.

Jaret Seiberg, managing director at TD Cowen, said it was "unsurprising" that the FDIC would retain some loans in the deal, particularly those without liability and loss protections. But the move would likely be productive in regulators' efforts to strengthen consumer confidence ahead of Monday's market open.

"There is a cost to that, which the FDIC may have decided was too high," Sieberg said. "More broadly, we see it as positive for consumer confidence for the branches to be opening Monday as NYCB branches."

Signature in recent years built a reputation as a crypto-friendly bank and had been struggling with deposits for several quarters as that market became more volatile. As of January 2021, more than 16% of the company's deposits were tied to cryptocurrency clients, and it had more crypto-lending deals in the works, including an agreement with the Boston-based stablecoin provider Circle.

The bank in May said that nearly $1.4 billion of deposits had left the bank since March 31.

The agreement came as

U.S. regulators cheered the move.

"We welcome the announcements by the Swiss authorities today to support financial stability," said Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen in a statement. "The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient. We have been in close contact with our international counterparts to support their implementation."

John Heltman contributed to this report.