A new Rural Housing Service construction-to-permanent loan program is garnering strong interest from lenders and builders who see it as a much-needed opportunity.

Vic Vance, chief executive of 1st Signature Lending in Indianapolis, knows that such lending can be hazardous at best. His first four construction-to-permanent loans turned into an "albatross" when the builder failed and took off with a lot of money.

Against the advice of his bankers, he didn't foreclose, Vance said in an interview. "I understand this process." Instead, he negotiated with all the parties, worked through all the liens and finished all four homes. "All four of those borrowers are in their homes and happy," he said.

Vance is one of the lenders who has signed up for the new RHS construction-to-permanent loan program, which is designed to boost interest in such loans. To be approved, RHS requires lenders to have two years' experience in construction lending.

Vance was the first to close on a Rural Housing Service construction-to-permanent loan, a process that can take between seven to eight months from the start of the application to the signing of the certificate of occupancy.

"RHS did an amazing job to put this construction loan together to meet the market needs for successful, affordable homeownership," Vance said.

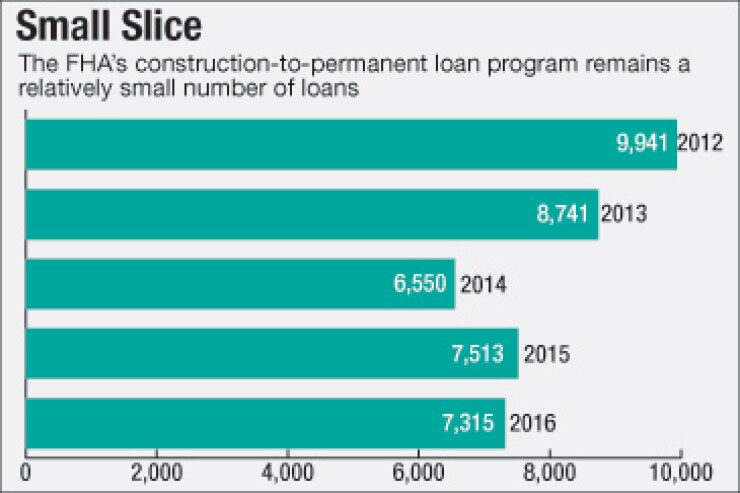

The Federal Housing Administration developed a construction-to-permanent program in the early 1990s, but it has not gained much traction with lenders because it doesn't insure the construction phase. The RHS program does, however.

"We're hoping that the RHS program, because it does cover the construction phase, will increase demand for C2P loans," said Michelle Hamecs, vice president for housing finance at the National Association of Home Builders.

To be sure, the borrower must meet RHS income limits, which vary by location, and the property must be located in a rural area as designated by the U.S. Department of Agriculture.

Vance said that many small banks don't like to do construction-to-permanent loans. "You either have to own the lot or put 20% down," he said.

Under the RHS program, a down payment is not required and the loan covers the cost of the lot. The average loan size is $260,000 to $270,000 in 1st Signature's area. The lender is licensed to operate in eight states and it is finding strong demand from builders.

A couple earning $70,000 a year can afford to buy a newly built home on the RHS program. The agency has lowered its upfront fee to 1% from 2.75%. It allows the borrower to "buy more house instead of paying fees," Vance said.

In the past year, new Consumer Financial Protection Bureau regulations have put a damper on construction-to-permanent loans, but that may be changing soon. Under a proposal issued in August, the agency is trying to clarify its TILA-RESPA integrated disclosure rules for construction-to-permanent loans.

"Many lenders have stopped doing construction-to-permanent loans because of TRID uncertainties," said Phillip Schulman, a partner at the law firm Mayer Brown in Washington, D.C.

The proposal "clarifies many of the previous landmines," Schulman said during an Oct. 5 webinar. And it "provides lenders with greater flexibility and answers to a number of nagging questions that lenders had about C2P loans."

For example, the proposal would clarify what costs and points should be allocated between the construction and permanent phases.

If a creditor charges an origination fee for construction only, but then charges a greater fee for a C2P loan, then the difference in the fees would get allocated to the permanent phase. "This should help lenders figure out where to allocate costs," Schulman said.