The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

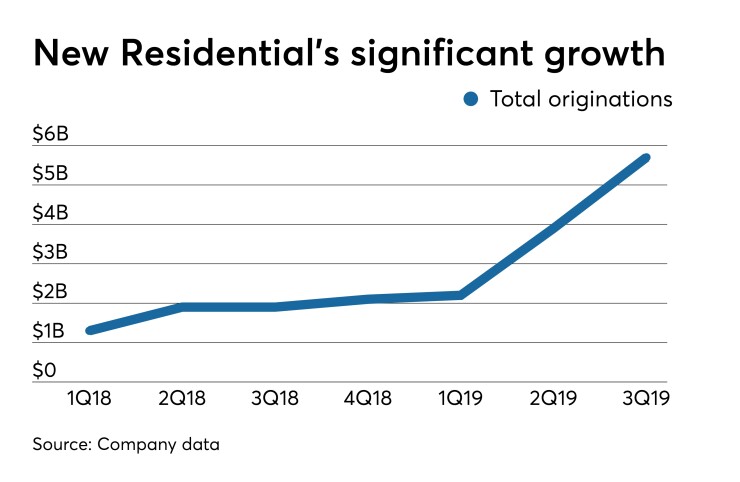

New Residential originated $5.7 billion in the third quarter, up from $3.9 billion in the second quarter and $1.9 billion in the third quarter last year. Refinancings made up 54% of third-quarter originations.

In the first nine months, it has $11.8 billion in loan originations. The addition of Ditech is expected to bring its 2019 total volume to $22 billion and its 2020 volume to $40 billion, New Residential said in its third-quarter earnings presentation.

New Residential was the stalking horse bidder for the

For the quarter, New Residential earned $224.6 million, compared with a

"The third quarter was another strong quarter for our business as we continued to make progress on a number of key initiatives, including protecting our book value and growing our origination, servicing and ancillary businesses," Michael Nierenberg, New Residential's chairman, CEO and president, said in a press release. "Despite the interest rate volatility during the quarter, our hedging strategy and portfolio performance resulted in a slight increase to our book value quarter-over-quarter.

"In the third quarter 2019, origination volume tripled and servicing volume doubled relative to the same period last year. The seasoned and credit impaired nature of our MSR portfolio, as well as sticky mortgage rates during the third quarter, contributed to the steady performance of those assets. Meanwhile, improving credit conditions benefited our bonds, loans and call populations," he said.

New Residential's servicing portfolio grew to $593 billion as of Sept. 30, up from $576 billion at the end of the second quarter. If Ditech's MSRs were included, New Residential would have a $650 billion portfolio.

New Residential completed a non-qualified mortgage securitization of approximately $381 million and a reperforming loan securitization with a balance of about $429 million in the quarter. It did seven total securitizations in the period, with a $3 billion balance.

It also funded $521 million of non-QM originations for NewRez.