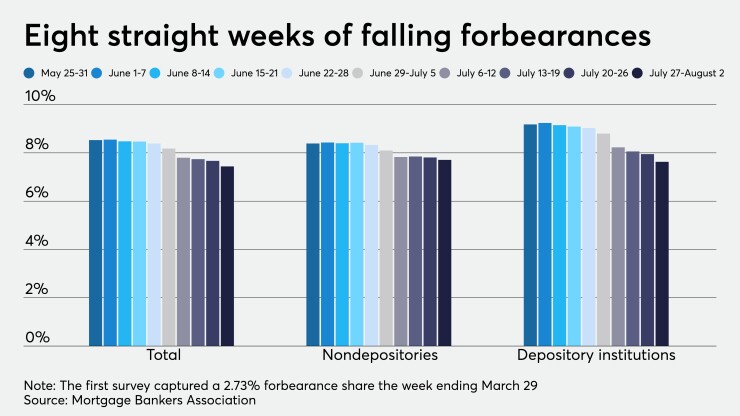

The pace of mortgages going into coronavirus-related forbearance declined for the eighth week in a row, plummeting 23 basis points between July 27 and August 2, according to the Mortgage Bankers Association.

An estimated 7.44% of all outstanding loans — or approximately 3.7 million — sat in forbearance plans compared to 7.67% and about 3.8 million

"New forbearance requests increased, but are still well below the level of exits," Mike Fratantoni, the MBA's senior vice president and chief economist, said in a press release. "Some of the decline in the share of Ginnie Mae loans in forbearance was due to additional

The forbearance share of conforming mortgages — those purchased by Fannie Mae and Freddie Mac — fell to 5.19% from 5.41%. Ginnie Mae loans — Federal Housing Administration, Department of Veterans Affairs and U.S. Department of Agriculture Rural Housing Service products — fell 22 basis points to 10.06% from 10.28%.

Private-label securities and portfolio loans — products not addressed by the coronavirus relief act — continued going up and down, this week dropping to 10.12% from 10.37%.

Amid some positive indicators, Fratantoni warned that current economic conditions may hinder borrowers who are trying to get out of forbearance.

"

Forbearance requests as a percentage of servicing portfolio volume rose to 0.12% from 0.1%, while call center volume as a percentage of portfolio volume also increased to 7.8% from 6.7%.

The MBA's sample for this week's survey includes a total of 52 servicers including 27 independent mortgage bankers and 23 depositories. The sample also included two subservicers. By unit count, the respondents represented about 75%, or 37.3 million, of outstanding first-lien mortgages.

Worries of all these forbearances becoming a tsunami of foreclosures ran rampant in the industry but have calmed in recent weeks. The housing market showed off its relative strength compared to the overall economy through the pandemic as a growing faction of borrowers

Foreclosures are usually a two-step process, happening at the confluence of "adverse economic shock" and low equity levels, leading to a "dual trigger hypothesis,"

"Alone, economic hardship and a lack of equity are each necessary, but not sufficient to trigger a foreclosure," Kushi said. "It is only when both conditions exist that a foreclosure becomes a likely outcome."