The low mortgage rates of August drove new homebuyers to cannonball into the purchase market compared to the year before, according to the Mortgage Bankers Association.

The group's Builder Application Survey showed a

"New-home purchase activity was robust in August, as

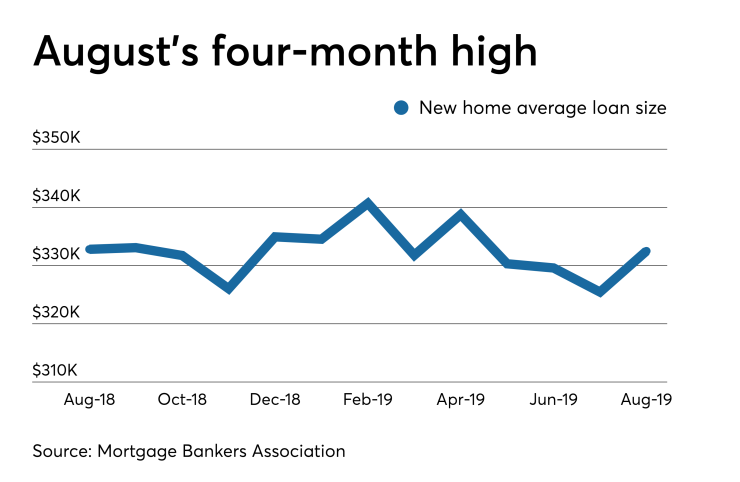

The average loan size of new homes hit its highest level in four months, reaching $332,497. The figure rose from July's $325,457 but fell slightly from $332,801 in August 2018.

New single-family home sales ran at a seasonally adjusted annual rate of 785,000 units in August, the MBA estimated based on data from the BAS. The rate rose from 669,000 units the year before and 754,000 units in July.

On an unadjusted basis, an estimated 61,000 new homes sold in August, up from 53,000 the year before but down from July's 63,000.

By loan type, conventional mortgages made up 69.3% of loan applications for a newly constructed property. While Federal Housing Administration mortgages accounted for 18.1%, those backed by the Department of Veterans Affairs represented 11.8%, and the Department of Agriculture Rural Housing Service loans the remaining 0.8%.

Concurrently, authorizations for new single-family construction during August fell 4.17% year-over-year and 1.06% month-over-month,

However, the low interest rate environment and more affordable housing inventory being built painted