Mortgage applications to purchase new homes dropped 8% in September from August, as ongoing uncertainty over interest rate movements and economy likely kept buyers out of the market, the Mortgage Bankers Association said.

However, when compared

"Last month's slowdown was likely caused by ongoing economic and interest rate uncertainty, as well as the fact that homebuilders continue to grapple with high building costs and labor shortages," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Purchase applications this year for new and existing homes for sale have consistently outpaced year-ago levels. This trend should continue in the final months of the year — especially considering how

On an unadjusted basis, the MBA estimated 56,000 new-home sales in September, a decrease of 8.2% from

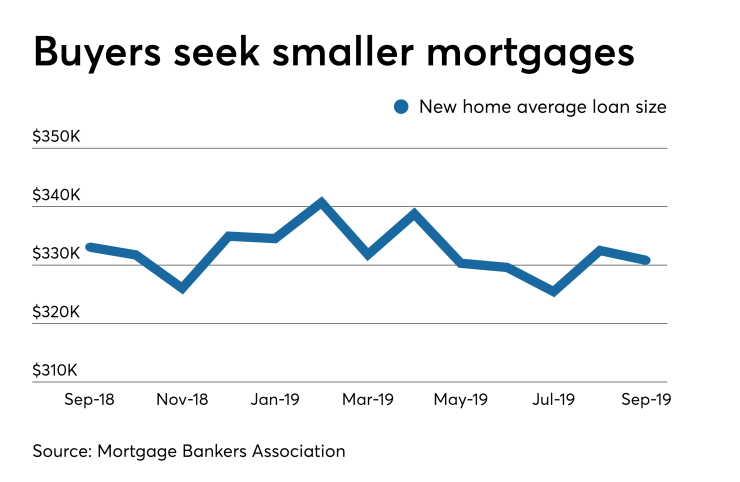

The average loan size for a mortgage to buy a new home decreased to $330,807 in September from $332,497 in August and $333,086 for September 2018.

Meanwhile, lower mortgage rates are boosting the homebuilding market, as single-family construction authorizations increased by 3.57% in September

"The housing market is beating expectations this month both through the lens of

"Amidst concerns of a recession, it's promising to see the housing market responding to the impact of mortgage rate decreases and other positive moves in the market. If housing continues showing the promise of growth, or even a leveling off, this activity has the potential to stimulate the larger economy."

In addition, the measures of existing housing maintenance activity increased on an annual basis for the third consecutive month.

Homebuilder sentiment, as measured by the National Association of Home Builders/Wells Fargo Housing Market Index, rose

Existing maintenance volume was up 5.54% on a year-over-year basis, compared with the "more gradual" increases of 1% in August and 2.36% in July, BuildFax said.

Remodel volume, a subset of maintenance that includes renovations, additions and alterations, was up 7.72% when compared with September 2018.