Low inventory caused new-home sales volume to decline in February despite gradual improvements in the economy and employment.

New-home purchase applications fell 9% from January while jumping 9.2%

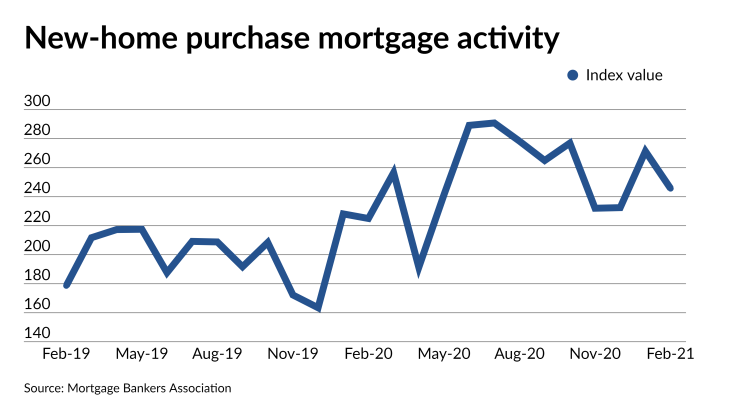

February’s seasonally adjusted estimate of 748,000 unit applications was the lowest monthly total since May 2020 and broke a seven-month streak of 800,000 unit apps per month. January’s estimate reached 905,000 units while February 2020 ran at 746,000 units.

Unadjusted estimates suggested 65,000 new-home sales took place in February, down 5.8% from January’s 69,000 while up 1.6% from 64,000 a year ago.

“

That imbalance drove the average new-home loan size to a record high of $370,679, up from $363,493 in January and $340,169 a year earlier.

Conventional loans hit a new high by making up 74% of applications. Loans insured by the Federal Housing Administration followed with a 15.4% share, mortgages guaranteed by the Department of Veterans Affairs composed 9%, and Rural Housing Service and U.S. Department of Agriculture loans accounted for the remaining 1.5%.

Comparatively, the month- and year-ago splits fell at 72.6% and 69.3% conventional, 16.2% and 18.5% FHA, 10.3% and 11.4% VA, and 0.9% and 0.8% USDA.