Want unlimited access to top ideas and insights?

Mortgage applications to purchase newly constructed homes continues to decline, driven by affordability concerns among potential buyers, the Mortgage Bankers Association said.

The MBA's Builder Application Survey for November was

"By our estimates, new-home sales fell almost 7% in November, and were about 5% lower than a year ago," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Despite a still-strong job market and

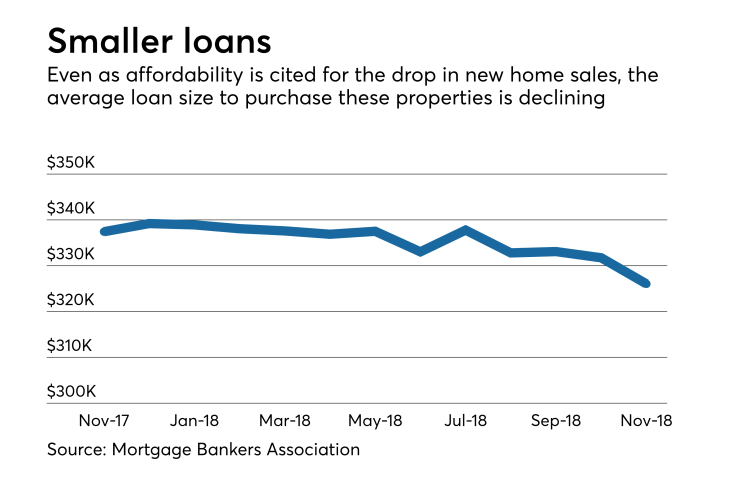

However, the average loan size for a new-home purchase continued to shrink, to $326,037 in November, from $331,732 the previous month and $337,427 one year prior.

New single-family home sales were running at a seasonally adjusted annual rate of 627,000 units in November, which the MBA calculated based on data from the BAS. This was down from 673,000 units in October and 663,000 units in November 2017.

On an unadjusted basis, the MBA estimated there were 45,000 new-home sales in November, a decrease of 15.1% from 53,000 in October and 47,000 in November 2017.

By product type, conventional loans composed 69.7% of new-home loan applications, Federal Housing Administration-insured loans composed 17.3%, Veterans Affairs-guaranteed loans composed 12.3% and Rural Housing Service/U.S. Department of Agriculture loans composed 0.7%.