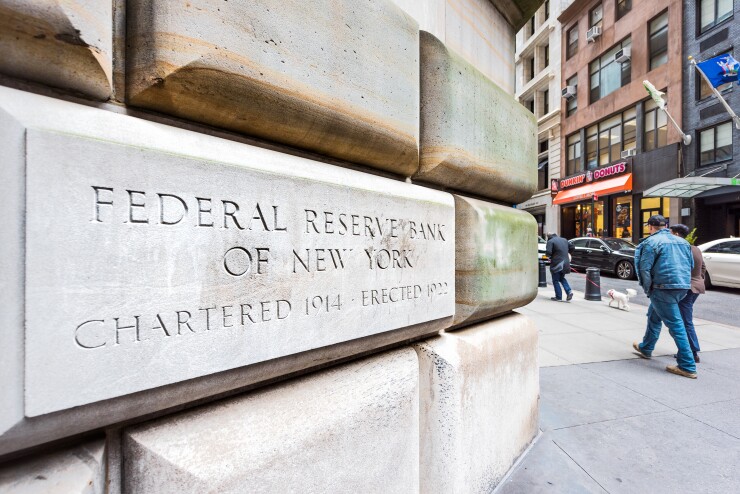

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

"Right now the only meaningful end buyer is the Fed and while they've been in the market every day this week, it’s not been near enough," Chris Bennett, principal at Vice Capital Markets, said in an email Thursday.

Thursday marked the second most volatile day in the market for securitized home loans, he said. Only Black Monday of the 1987 stock crash was more volatile.

The New York Fed announced an additional $15 billion in purchases Friday afternoon on top

Even if the MBS market stabilizes somewhat due to the Federal Reserve Bank of New York's support, the rates mortgage lenders offer consumers still may be all over the map due to pricing policies they may implement to control volume relative to their own capacity.

Mortgage rates during the week of March 20 have ranged from 3% to 5%, boosting the average

Another sign that lenders have been having trouble with capacity is that — despite anecdotal reports of high demand —

"The volume is still very, very strong," said Paul Buege, president and chief operating officer at home lender Inlanta Mortgage.

However, secondary market investors are starting to tighten their criteria by doing things like requiring employment verifications closer to the date of closing than usual, he noted.