Mortgage performance got back on track in August following

The share of home loans late by more than 30 days or in foreclosure inched back down to 2.8% from 3% the previous month and also was 1.2 percentage points lower than a year earlier.

"The share of U.S. borrowers who are six months or more late on their mortgage payments fell to a two-year low in August and was less than one-third of the pandemic high recorded in February 2021," said Molly Boesel, principal economist at CoreLogic, in a press release. "Furthermore, the

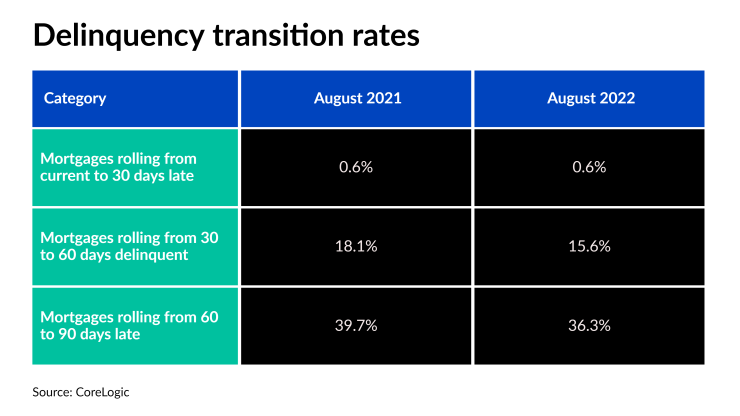

Year-over-year comparisons in roll rates also largely suggest 2022's mortgage performance is strong.

The percentage of people rolling to more than 90 days late from 60 was 36.3%, down from 39.7% during the same month in 2021. The share of consumers who went from 30 days late to 60 was 15.6% compared to 18.1% in August of last year.

Only the share of borrowers rolling from current to 30 days late remained unchanged at 0.6%.

CoreLogic expects more strain on delinquencies could materialize in the future due to

"The still-healthy job market continues to help homeowners with a mortgage make payments on time. However, as the cost of basic necessities mounts with rising inflation, mortgage delinquencies could increase in the coming months as more borrowers see their monthly household budgets stretched further," the company noted in its report.

Loan performance has generally been less consistent this year due to these factors.