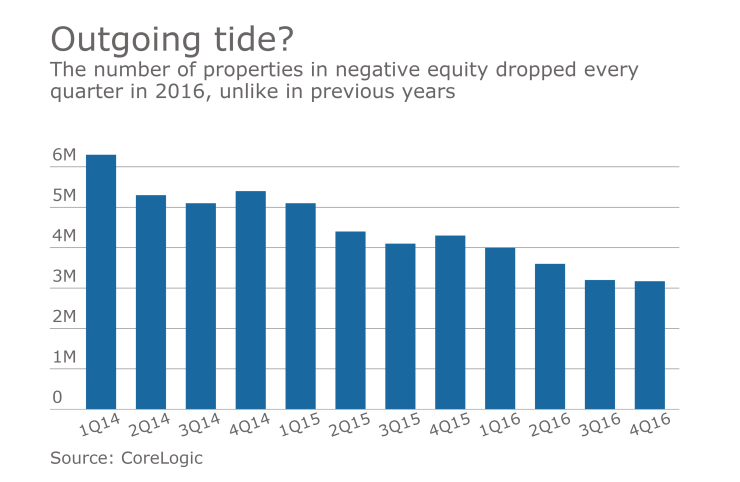

The number of underwater properties nationwide decreased once again in the fourth quarter, CoreLogic reported Thursday.

The total number of mortgage properties with negative equity dropped to 3.17 million, or 6.2% of all homes with a mortgage. This represents a 2% dip from the third quarter and a 25% decrease from a year earlier.

In total, 1 million borrowers moved out of negative equity over the course of 2016, and borrowers gained $784 billion in equity.

"Average home equity rose by $13,700 for U.S. homeowners during 2016," Frank Nothaft, chief economist for CoreLogic, said in a news release. "The equity build-up has been supported by home-price growth and paydown of principal."

Nothaft added that faster equity accumulation is also the result of nearly a fourth of all outstanding mortgages having a term of 20 years or less.

Nevada had the largest share of homes in negative equity with 13.6%, while Texas had the lowest at 1.6%.