Prices in the United States have gotten so high that nationally, the share of mortgaged homes with negative equity has fallen to a survey-record low, according to CoreLogic.

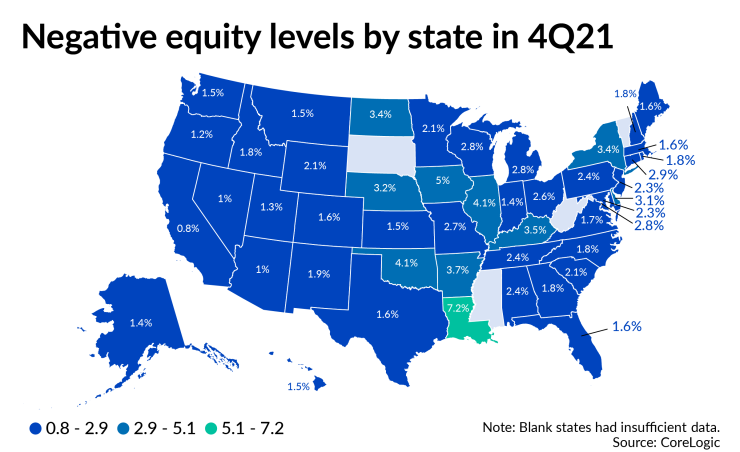

Just 2.1% of all residential properties with loans had values worth less than the debt they carried in the fourth quarter of last year, compared with 2.8% a year earlier and the peak of 26% seen in the fourth quarter of 2009, following the Great Recession.

That means home equity levels remain high enough to keep generating cash-out refinancing opportunities and will deter foreclosure actions in many areas, but in certain pockets of the country, underwater mortgages will still be an issue.

“There are still a lot of people, 1.1 million loans, that are in a negative equity position,” said Frank Nothaft, chief economist at CoreLogic, in an interview.

If those borrowers are distressed, they may not be able to exit forbearance without selling their home for an amount less than they owe on their mortgage.

“We'll see…both foreclosures and short sales in the marketplace, but we're not expecting to return to anything like the foreclosure wave that we saw in 2008, 2009, and 2010, when home prices were falling everywhere,” Nothaft said.

Louisiana had the highest recorded concentration during the fourth quarter of 2021, with 7.2% of mortgages underwater. The state was hit hard by

Researchers at the Federal Housing Finance Agency, which is responsible for managing taxpayer exposure to government-related mortgage investments, have warned that prolonged exposure to rising home prices could intensify negative-equity risk in the event of a new economic shock.

While the share of homes with underwater mortgages hit a record low in the fourth quarter of 2021, the amount of negative equity rose by 1.8% year-over-year to $287.5 billion from $282.4 billion in 4Q20, CoreLogic found.

That said, for borrowers across the board, the average annual change in equity during the fourth quarter of 2021 was a positive $55,300.

The largest, average equity gains during that period were seen in Hawaii, $128,300; California, $117,000; and Washington, $95,000. The smallest were in Washington, D.C., $11,000; and North Dakota, $16,800.

While rising equity levels and prices can strain consumer finances, recent strength in U.S. employment numbers and the latest reading on property tax delinquency data suggest homeowners are bearing up well under the pressure. The national average for tax delinquencies