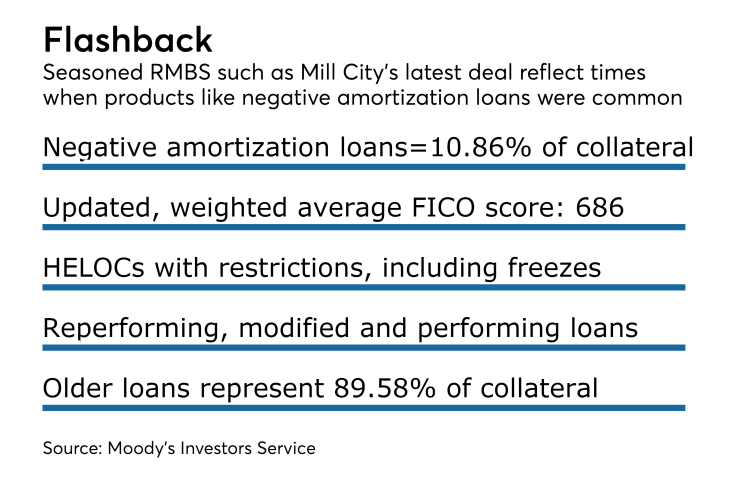

Mill City used negative amortization loans to make up 10.86% of the collateral in its latest deal, marking the largest concentration of such loans in a securitization seen since the financial crisis.

"Post-crisis, this is the first time we've seen a large amount," said Sang Shin, a vice president and senior analyst in Moody's Investors Service's structured finance group.

The collateral pool in the Mill City deal is primarily comprised of seasoned loans.

A general decline in interest rates since origination has helped reduce the stress on negatively amortizing loans originated in 2006-07, but negative amortization could put additional stress on borrowers in a rising interest rate environment, according to Moody's.

Payment shock associated with negative amortization loans caused them to fall out of favor and draw regulatory scrutiny during the crisis. The loans give borrowers the option of making a minimum payment that doesn't cover their interest and that would require them to make higher payments later.

A pool of $382.4 million reperforming modified and performing mortgages, as well as home equity lines of credit collateralize the Mill City transaction, according to Moody's presale report. The HELOCs are subject to various restrictions, including freezes in the event home values fall below a certain level. Mill City's previous deal this year also

The negative amortization loans in the private-label Mill City Mortgage Loan Trust 2017-2 deal have rates that reset monthly and their monthly payments and amortization schedules generally adjust annually, subject to caps and other limitations.

The collateral pool has an updated weighted average FICO credit score of 686.

Many of the nonagency securitizations done post-crisis have been comprised of loans from the pre-crisis period, when a much larger percentage of loans were originated for sale to the private secondary market.

However, the volume of pre-crisis loans available in the market has declined over time. More than 10% of the loans backing the Mill City deal were originated on or after Jan. 1, 2010.