Mr. Cooper Group took a net loss of $136 million in the fourth quarter of 2018 after lower rates hit the mark-to-market fair value of its mortgage servicing rights portfolio harder than its peers.

While other nonbanks like Ocwen and PennyMac recorded smaller declines in the values of their portfolios at $43 million and $67 million, respectively, Mr. Cooper's fair market value was down by $188 million.

Most servicers suffered mark-to-market declines in portfolio value during the quarter, but results were stronger at some due to the use of interest rate risk management strategies. PennyMac, for example, was able to largely offset its MSR fair value losses with associated hedging gains and record more than $58 million in pretax income during the period, according to the company's earnings presentation.

And Mr. Cooper is considering changing its interest rate risk management strategy as a result.

"Historically, Mr. Cooper chose not to employ derivative hedges for the MSR, but rather than manage interest rate risk by selling excess spread to capital partners, investing in our operational recapture capabilities, and emphasizing growth in the subservicing portfolio. And in recent years, this was exactly the right strategy that positioned us to benefit from rising rates. Now, we'll revisit that strategy this year and share any changes with you if and when we make any," Chris Marshall, vice chairman of Mr. Cooper Group, said in the company's earnings call.

Mr. Cooper's overall net loss represented a sharp decline from the $41 million in net income generated by predecessor company Nationstar in

The company has been working to

Excluding the mark-to-market adjustment to the fair value of the company's servicing portfolio, servicing produced $88 million in pretax income for Mr. Cooper in the fourth quarter.

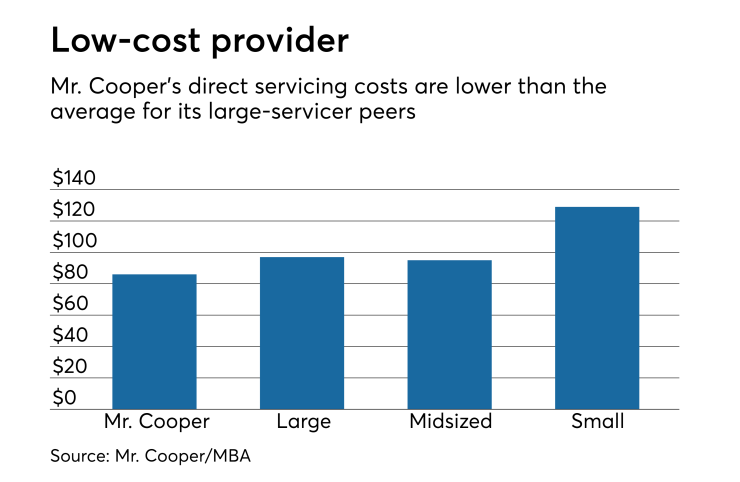

"Fourth-quarter results showcased the growth and margins of the company's market-leading servicing platform, and by executing on our servicing transformation initiative, project Titan, we intend to drive further efficiencies and improve the servicing experience for team members and customers," Marshall said in the company's earnings release.