Mr. Cooper’s latest earnings show that the company has been able to remain profitable, using originations to offset servicing losses while bracing itself for future risks.

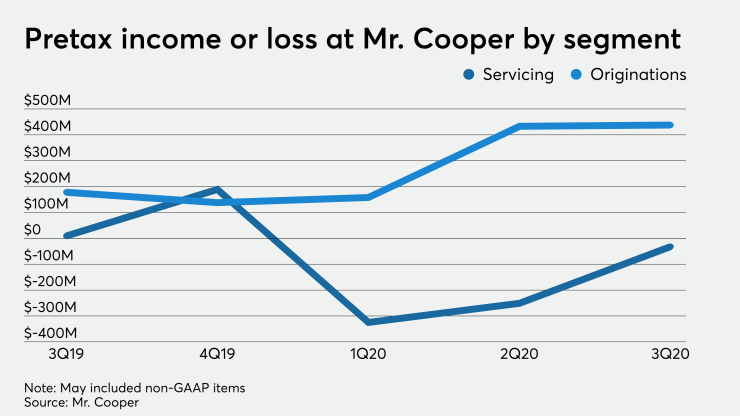

The mortgage company generated $214 million in net income in the third quarter, which reflects in part a record $438 million in pretax income from origination and a $32 million net pretax servicing loss, according to a portion of the company’s earnings statement that includes some unaudited and non-GAAP figures.

That net income is nearly three times the $73 million in net income seen in

The company’s most recent earnings results show that its servicing unit’s fortunes have changed from a year ago, when that division of its business generated $9 million in pretax income.

During

Being well aware that it has a large servicing operation vulnerable to the toll that prepayments from refinancing and forbearance could take on it, Mr. Cooper has been shoring up its cash resources in case it runs into challenges in the future, Chairman and CEO Jay Bray said.

“We further strengthened our liquidity by obtaining a two-year committed line for Ginnie Mae advances,” he noted during the company’s earnings call on Thursday. A private company provided the funding line.

“We were the first servicing company to obtain this type of financing and it is a real game-changer for us,” Bray added. “It brings our total unused advanced capacity to $1.5 billion, which we feel positions us for an extremely adverse economic scenario should one occur. And if one does not occur, it provides dry powder for future Ginnie Mae acquisitions.”

Mr. Cooper services mortgages with a collective unpaid principal balance of $588 billion. The company originated $15.6 billion in loans during the quarter, up 45% from $10.7 billion the previous quarter and $11.9 billion during the same period a year ago.

There has long been concern that the traditional pricing regime used to compensate servicers may not be adequate given the costs of the highly regulated business. These costs are particularly high in the distressed servicing space.

Mr. Cooper had a 6.1% forbearance rate as of Oct. 25, down from a peak of 7.2%, Chris Marshall, executive vice president and chief financial officer, said during the company’s earnings call.

The was relatively little demand for advance financing in the period just prior to the pandemic because most borrowers were paying, and servicers were doing very little advancing of payments on behalf of borrowers who weren’t making them.

But now that more advancing is occurring, there is more demand for this type of financing, and more forms of it

The new financing Mr. Cooper has will help reduce the demands advancing obligations could put on its liquidity.

“In the past, we had no way to finance Ginnie Mae advances. Now we have a $900 million facility, which is really a significant amount of funding capacity. What this means is that should we encounter any adverse scenario, the drag on our discretionary cash flow would be limited to the haircut on advances,” Marshall said.