Mr. Cooper, after completing the

Xome Valuations is being sold to Voxtur Analytics, a Toronto-based company with operations on both sides of the border, for a total of $15 million, of which $6 million will be in stock and the rest in cash. The Mr. Cooper press release described the consideration as "not material."

Mr. Cooper had first

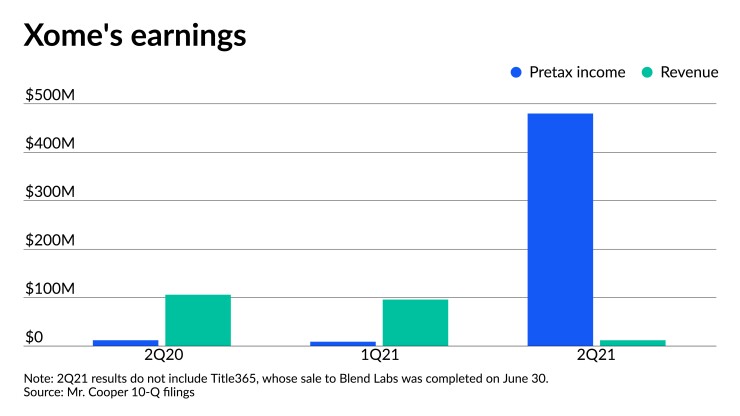

In the second quarter, which does not include any results from Title365, Xome had pretax income from continuing operations of $480 million and revenue of $39 million. For the same period last year, which included $52 million in Title365 revenue, Xome had $12 million in pretax income from continuing operations on revenues of $106 million.

"This transaction is another example of how we are rationalizing and simplifying to focus on our core businesses, where we see tremendous opportunity for growth," said Jay Bray, Mr. Cooper chairman and CEO, in the press release. "We are thankful to the Valuations team for their contributions to the organization, and we will work closely with Voxtur to ensure a smooth transition for our team members and clients."

These sales strip Xome down to just one business line. “We believe the decision is in the best interest of our business, our team and our stakeholders, and streamlining Xome’s services to focus on end-to-end asset management capabilities will better position the company for the future,” a company statement added. “We are committed to ensuring a seamless experience for our Xome Valuations team members and clients as they transition to Voxtur.”

Earlier this year, Voxtur acquired

"Valuations are manual, time-consuming processes for lenders and consumers, and by bringing all parties into the same automated platform we can vastly improve the experience," Voxtur Executive Chairman Gary Yeoman said in that company's release. "With an intense focus on clients and operational efficiency, Xome Valuations is the right match to help us scale our efforts and make an immediate impact in the valuation industry."

The Xome Valuations team will continue to be led by Al Broadway as president.

This transaction is expected to close in the current quarter, subject to regulatory approvals, including by the TSX Venture Exchange.