Mr. Cooper notched a nearly twofold jump in net profit from quarter to quarter, due to mortgage-related gains, company executives told analysts during an earnings call Thursday. They also discussed why some customers received unauthorized

The company generated $561 million in net income in the first three months of this year despite lower origination margins, far outpacing

The increase in price suggested investors liked the way Mr. Cooper’s efficiencies and countercyclical business mix outweighed margin pressures on origination during the fiscal period.

“While there was some volatility along the way, we’ve demonstrated solid profitability and resilience,” Mr. Cooper's chairman and CEO, Jay Bray, said during the company’s earnings call.

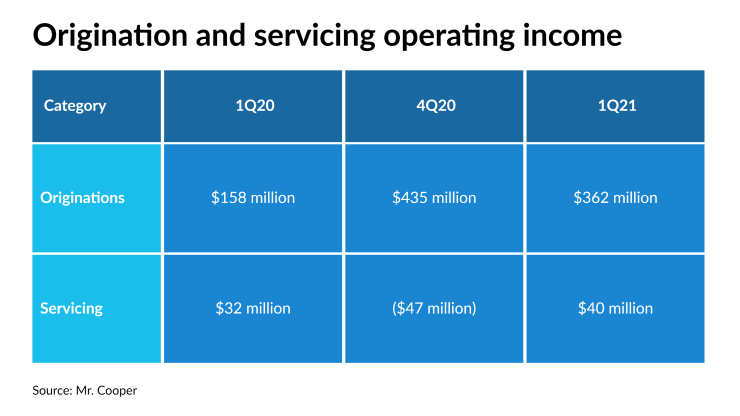

The $362 million in origination operating income seen during the quarter was historically strong compared to $158 million during the same period a year ago, but it was down from $435 million in the final three months of last year.

Servicing operating income, which Mr. Cooper is counting on to partly offset diminishing origination volumes and returns, totaled $40 million. That’s up from a loss of $47 million the previous quarter and $32 million in the first quarter of 2020.

Although total origination volume set a record for the company during the first quarter at $25.1 billion, up from $24.5 billion the previous quarter and $12.4 billion during the initial three months of last year, the most recent near-term gain was relatively small.

In addition, during the period it purchased more of its volume from the competitive correspondent channel, which contributed to a drop in its production margins to 1.63% from 1.86% the previous quarter. However, margins were up from 1.48% in last year's first quarter.

Besides cutting costs and positioning itself for servicing gains, Mr. Cooper is marketing fewer rate-sensitive mortgages like

“By the time we reach the second half of the year, we should have a small war chest,” Bray said.

One key contributor to this could be

Mr. Cooper is facing other potential regulatory uncertainty regarding

Mr. Cooper is conducting an ongoing investigation into the cause of the unauthorized charges. Early reports from that suggest there may have been an accidental introduction of test files designed to test capacity into a production environment, said Bray.

The number of customers requiring reimbursement for banking fees incurred as a result of the excessive drafts was originally estimated at around 100. It now looks to be closer to a few hundred, but that’s still a small number of the total 480,000 customers impacted, Bray said.

“We did reach out to all of our stakeholders, including the regulatory community, and we had discussions with a number of them and those discussions have gone well. They’re going to want to see how this continues to unfold,” said Bray. “We see call volumes back to normal, we see less and less inquiries related to this from customers. The level of activity overall has gone down. So I think the fact that it’s ultimately not going to be a material impact to our customers, I think that will influence the regulatory community.”