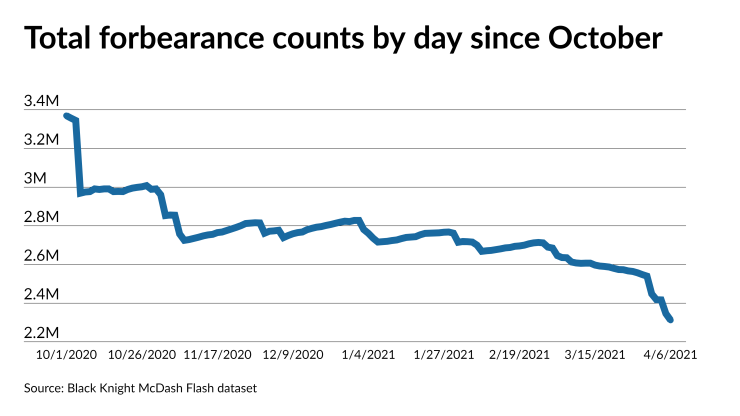

The number of mortgages with payments suspended due to hardships just plummeted more than it has in any week since October, according to a report released by Black Knight on Friday.

There were over 2.3 million loans in forbearance during the week ended April 6. That represents a 9% drop from the previous week and is up more than 13% from over 2 million a year ago. Borrowers were just beginning to request postponed payments around this time in 2020.

The recent falloff could be significant if it reflects borrower optimism about economic recovery as vaccines roll out. However, it may instead be a short-lived decline related to a previous forbearance deadline

But in its weekly report, Black Knight said “the decline is largely driven by early forbearance entrants exiting their plans at the 12-month mark (and what would have been their final expiration prior to extensions).”

There were 280,000 exits and 158,000 entrances and restarts in the past week.

Overall, forbearance rates have been in the 4-5% range and a falloff has been seen across investor groups, according to separate reports by Black Knight (4.4%) and the Mortgage Bankers Association (4.9%).

More than 21% of all borrowers currently in forbearance have extensions that have exceeded 12 months, the MBA found in a report issued Monday.

The percentage of borrowers who have exited forbearance last month and requested modified loan terms due to a drop in their incomes also tops 21%, MBA statistics show.