Want unlimited access to top ideas and insights?

Mortgage servicers are not doing enough to keep borrowers loyal when it comes to the next loan.

Only 17% of borrowers will use their same servicer to originate or refinance a mortgage loan, according to the Mortgage Bankers Association.

"I would argue that over 50% of the servicers in this country continue to think about the customer as the investor, not as the borrower. We really need to start thinking more outside the box and thinking about how as servicers we can do more," said Roberto Hernandez, partner at financial services company PwC.

So much attention is paid on the originations side to delivering a positive customer experience, but these efforts fall short on the servicing side, meaning servicers are passing up potential opportunities to strengthen customer satisfaction and retention.

"The category has been built off of billing statements and a call center. The world has to be bigger than that," said Barbara Yolles, chief strategy officer at The Money Source.

Hernandez and Yolles were among panelists at the MBA's Mortgage Servicing Conference in Orlando, Fla.

The same way that on the originations side lenders are investing in digital mortgage tools, calculating rate comparisons and educating customers on product offerings, servicers can offer assistance options, educate borrowers on why payments may have changed and explore ways to streamline processes to support a better experience.

"Here you have this readily available pool of borrowers who could refinance or could decide to upgrade and move into a home. And when you look at customer retention, when you look at those borrowers who are paying off their mortgage, either to buy a new home or to refinance, we have a very scary statistic that shows less than one in five will use their servicer," Marina Walsh, the MBA's vice president of industry analysis research and economics, said in an interview with National Mortgage News.

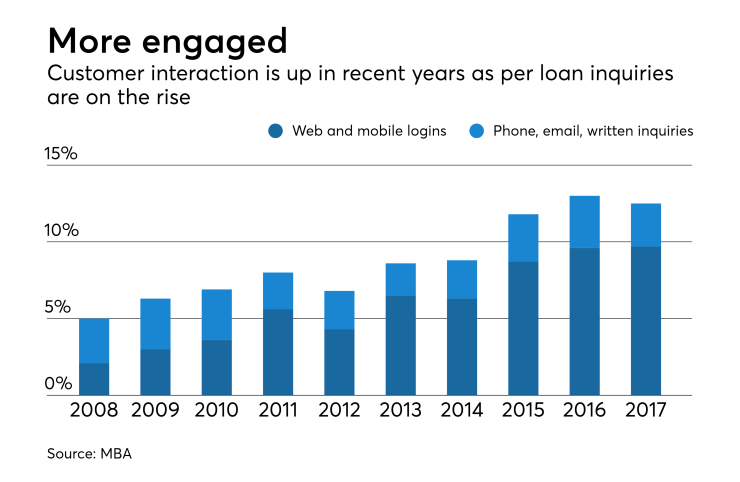

What's more, consumer interaction is up in recent years based on growth in website and mobile logins per loan, making it easier for servicers to get in front of borrowers, according to the MBA. This presents even more opportunity to provide things like ancillary services or even cross-sell products.

"Borrowers are logging in. The idea is, how do you translate this into something of value," said Walsh. "There's not enough of a 'wow factor' in servicing for the borrower to go that direction and call their servicer and say, 'hey can you give me a better offer.'"

While the argument may stand that investing money in the customer experience on the servicing side presents financial roadblocks while not supporting the segment's core purpose, the turnaround could be tremendous should borrowers develop allegiance to their servicers.

Some of the country's largest banks who service still get around half of their volume from third-party correspondent channels when they could be leveraging their own customer base, according to Walsh.

"As a servicer we have to educate customers; we have to help them navigate the complexities of this very difficult purchase, provide them content," said Yolles.

"We need to constantly be giving them information so that they feel we're championing their success. If you do that, they build a bond with you. If you add value to their life, they will feel more sense of loyalty to you than they might to somebody else, and that can be the difference maker," she said.