Servicers' struggle to retain borrowers mounted in the fourth quarter of 2019 as the volume of cash-out refinances rose to a more than 10-year high, according to Black Knight.

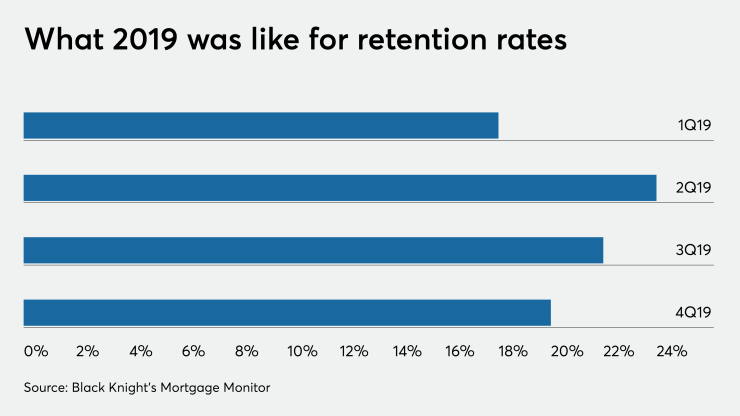

Retention rates fell 2 percentage points on a consecutive-quarter basis to 20% in the fourth quarter, when cash-out production volume levels were the highest they've been in a quarter since 2007.

Cash-out refis in the fourth quarter of last year had a 17% recapture rate, which, like the overall retention rate, was down 2 percentage points from the previous quarter.

The latest downward move in the overall retention rate almost completely reverses a jump to 24% in

Prior to recording an 18% retention rate in 1Q19, Black Knight had never reported a retention rate lower than 20%. Black Knight began tracking retention rates in 2005.

A measure of retention rates the Mortgage Bankers Association's released at its annual servicing conference in Orlando, Fla., last week suggested they've been below 20% since 2017 and peaked at 36% in 2012.

In addition to high volumes of cash-out refis, developments in third-party loan channels may be playing a role on low retention rates.

Mortgage wholesalers have been doing more to refer borrowers back to loan brokers in order to compete for third-party originators' business, and increased use of the correspondent channel to aggregate loans sold servicing-released can complicate retention efforts.