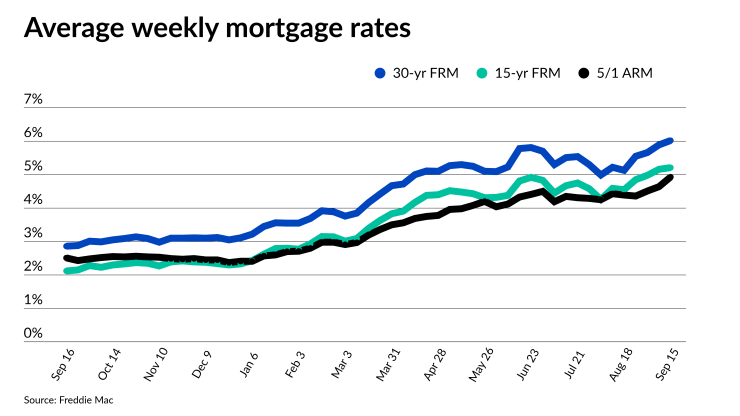

On-again-off-again inflation concerns pushed mortgage rates past 6% for the first time in almost 14 years, according to Freddie Mac.

The 30-year fixed-rate average surged 13 basis points to 6.02% for the seven-day period ending Sept. 15, according to Freddie Mac's weekly Primary Mortgage Market Survey.

"Mortgage rates continued to rise alongside hotter-than-expected inflation numbers this week, exceeding 6% for the first time since late 2008," Freddie Mac Chief Economist Sam Khater said in a press release.

The 15-year fixed-rate average also increased a week after it crossed the 5% mark for the first time since 2009. The rate rose another 5 basis points to 5.21% from 5.16%. Like the 30-year FRM, this average is now more than 3 percentage points higher from the same week last year, when it came in at 2.12%.

Meanwhile, the 5-year Treasury-indexed hybrid

Hotter-than-expected

"Inflation numbers were modestly better than last month, but fell short of the reduction markets were hoping for," said Marty Green, principal of Polunsky Beitel Green, in a statement.

"Most market participants now fully anticipate that the Federal Reserve Open Market Committee will increase the federal funds rate by 75 basis points at their September meeting, rather than a more modest 50 basis point increase that many thought was more likely a few weeks ago," he said.

The FOMC is expected to announce its plans after meetings scheduled for next week.

For consumers, the latest news won't alleviate any of their concerns, with the market continuing to struggle with ongoing affordability issues. Although higher rates will dampen demand, inventory remains inadequate, so the full effect on buyers is still unknown.

"The question is whether the increase in rates will be offset somewhat by sellers reducing the sales price on homes in many markets," Green said.