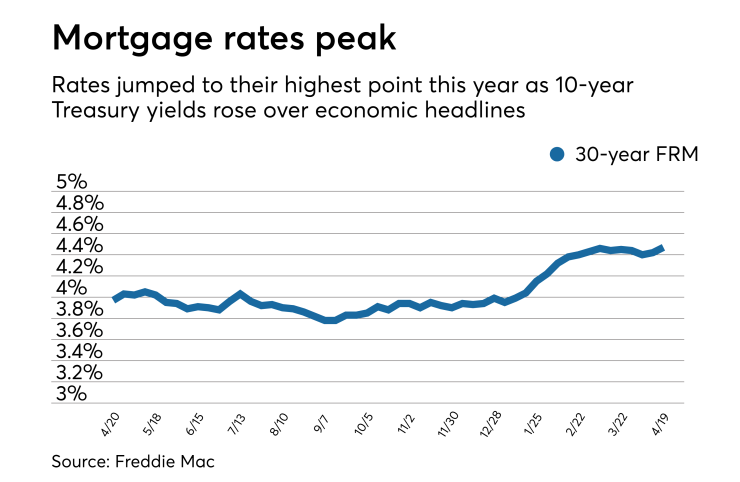

Mortgage rates jumped across the board to their highest point this year as 10-year Treasury yields rose in the past week over economic headlines, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.47% | 3.94% | 3.67% |

| Fees & Points | 0.5 | 0.4 | 0.3 |

| Margin | N/A | N/A | 2.76 |

"Treasury yields rose ahead of the release of the Fed's Beige Book and speeches from New York Fed President William Dudley and Fed Gov. Randal Quarles," said Freddie Mac Deputy Chief Economist Len Kiefer in a press release. "According to the Beige Book, economic activity in March and early April continued to expand at a moderate pace, however there is concern from various industries surrounding tariffs."

The 30-year fixed-rate mortgage averaged 4.47% for the week ending April 19,

The 15-year fixed-rate mortgage this week averaged 3.94%, up from last week when it averaged 3.87%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.23%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.67% this week with an average 0.3 point, up from last week when it averaged 3.61%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.1%.

"Mortgage rates increased last week as the prospect of an expanded conflict in the Middle East flared up around military strikes in Syria, but retreated as a broader conflict failed to materialize,” Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

"Geopolitical headlines have temporarily seized markets’ attention — and could do so again this week — but the underlying macroeconomic fundamentals continue to point to a relatively strong U.S. economy and gradually rising rates over the coming months," Terrazas said.