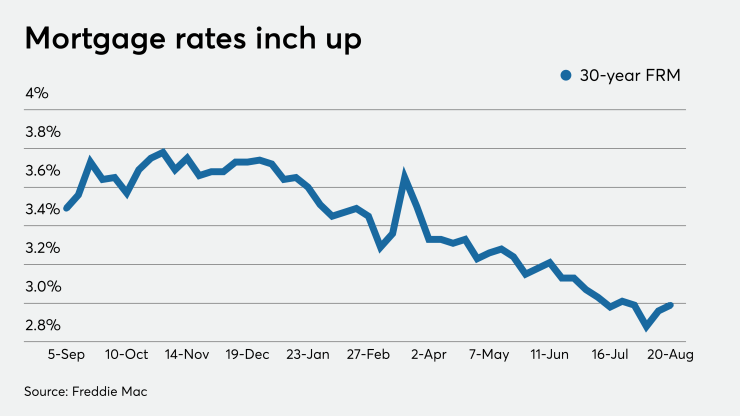

Mortgage rates crept up this week, nearly reaching the 3% mark as lenders raised prices because of a new fee, although purchase activity remained solid, according to Freddie Mac.

Zillow Economist Matthew Speakman said the rate increase was probably caused by the

"Despite seeing some substantial changes in the past six months, most of the key data released during the pandemic has not caught mortgage lenders by surprise. The announcement by the FHFA to apply a 0.5% fee to all mortgage refinance loans was one that caught lenders off guard, placing many in a difficult financial spot and forcing them to raise rates across the board — even for purchase loans, which aren't directly affected by the new policy — in order to cover their losses," Speakman said in a commentary released Wednesday night for its rate tracker.

But those rising rates did not seem to deter homebuyers, Freddie Mac said.

"Purchase housing demand continues to accelerate, ultimately providing support to an economy that otherwise has stagnated," Sam Khater, Freddie Mac's chief economist, said in a press release. "The surge in sales led to a rapid increase in the demand for remodeling and home furnishings as consumers look to renovate while adjusting to home life during COVID."

The 30-year fixed-rate mortgage averaged 2.99% for the week ending Aug. 20,

The 15-year fixed-rate mortgage averaged 2.54%, up from last week when it averaged 2.46%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.03%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.91% with an average 0.3 point, up from last week when it averaged 2.9%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.32%.

Going forward, the adverse market fee will have as much of an influence on rate movements as financial and economic news and COVID-19, Speakman said.

"For the last few months, mortgage rates have moved as a result of key data (which have shown sharp deteriorations and subsequent quick, partial rebounds), but much of the time, the impact of any given release had already been priced into rates," Speakman said. "The path for rates in the near future will continue to be dictated by key data, as well as coronavirus-related developments — but last week's refinance fee announcement lifted the baseline level from which rates will move."