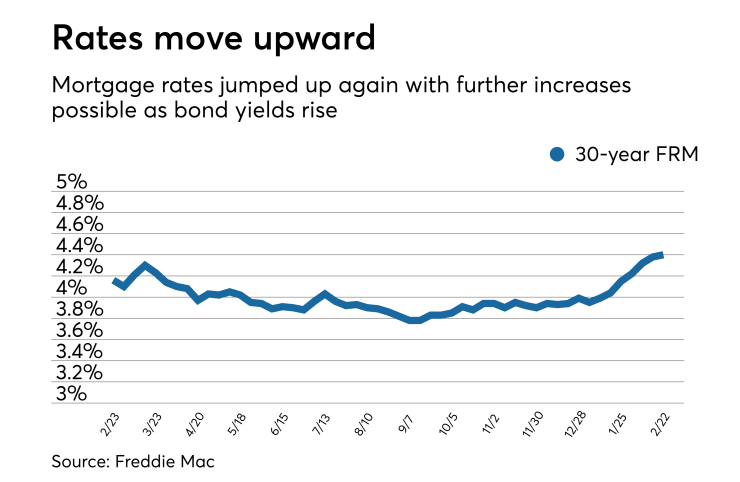

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 4.40% | 3.85% | 3.65% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.4% for the week ending Feb. 22,

"Mortgage rates have followed U.S. Treasuries higher in anticipation of higher rates of inflation and further monetary tightening by the Federal Reserve. Following the close of our survey, the release of the Federal Open Market Committee minutes for Feb. 21 sent

The 15-year fixed-rate mortgage this week averaged 3.85%, up from last week when it averaged 3.84%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.37%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.65% this week with an average 0.4 point, up from last week when it averaged 3.63%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.16%.

"After surging last Wednesday on the heels of strong inflation data, mortgage rates held steady near four-year highs last week," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

"The main event markets will be watching is the first speech from newly installed Fed Chair Jerome Powell. Additionally, markets are likely to keep an eye on several speeches by key FOMC voters this week, and an important leadership change at the European Central Bank which could shift European monetary policy toward a more hawkish stance," Terrazas said.