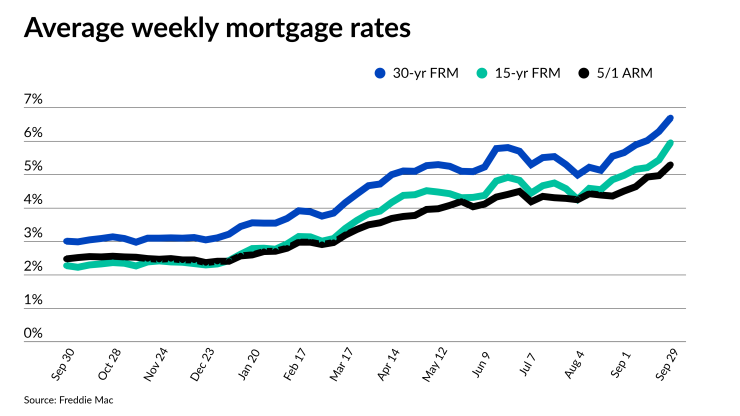

Mortgage rates shot up another 41 basis points for the week ended Sept. 29, according to Freddie Mac, as the benchmark 10-year Treasury yield tested the 4% mark and the mortgage-backed securities markets were in turmoil.

The Freddie Mac Primary Mortgage Market Survey found the 30-year fixed-rate mortgage averaged 6.7% up from

The last time mortgage rates were this high was in

A

"The uncertainty and volatility in financial markets is heavily impacting mortgage rates," said Sam Khater, Freddie Mac's chief economist in a press release. "Our survey indicates that the range of weekly rate quotes for the 30-year fixed-rate mortgage has more than doubled over the last year."

On Sept. 27, the 10-year Treasury yield peaked at 3.99%, according to Yahoo Finance, although other sources, including MarketWatch, put it at 4.01% for a brief period of time. It closed at 3.96%

But in a display of the volatility that Khater mentioned, the 10-year dropped 25 basis points to close at 3.71% on Sept. 28. The following morning, it opened at 3.82%.

Meanwhile, MBS spreads, another component in deciding mortgage pricing,

A look at daily mortgage rate data on the Black Knight Optimal Blue website showed the 30-year conforming mortgage went from approximately 6.399% on Sept. 22 to 6.785% on Sept. 27 before falling back to 6.643% the following day.

"Markets reacted to the Federal Reserve increasing the target fed funds rate by 75 basis points last week and increasing their projections of future rate levels in 2023," Zillow Home Loans Vice President Paul Thomas said in a statement. "Fed Chair [Jerome] Powell's comments last week noted a need for restrictive monetary policy in the future with a focus on containing inflation, driving investors to raise their expectations for future interest rates."

On the other hand, Thomas noted that parts of the U.S. economy are resilient, such as employment, something that can be an indicator of rising defaults. For example, last week's jobless claims data showed labor markets remained very tight.

As for the outlook for mortgage rates for the next seven days, "this week, markets are focused on comments from numerous Fed officials to ascertain their willingness to endure economic slowdowns to fight inflation," said Thomas. "New inflation data coming later in the week could provide further insight into future Fed rate hikes."

Other rates tracked by Freddie Mac also showed large week-to-week increases. The 15-year FRM averaged 5.96%, up from last week when it averaged 5.44% and 2.28% one year ago.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 5.3% compared with 4.97 one week prior and 2.48% for the same week in 2021.