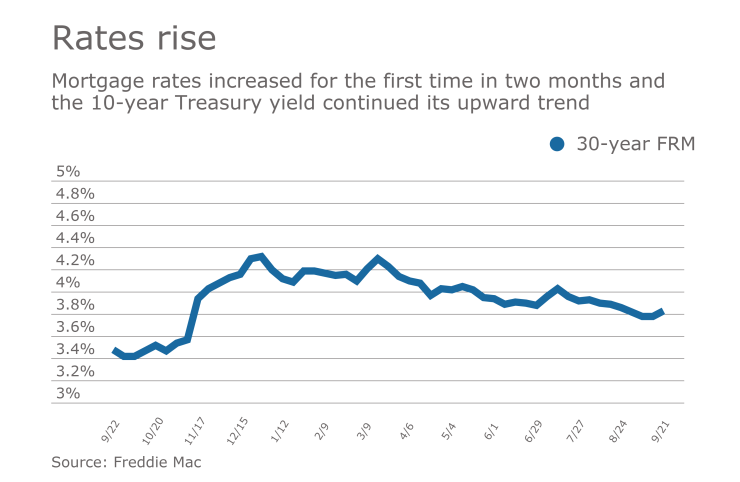

The 30-year fixed-rate mortgage averaged 3.83% for the week ending Sept. 21,

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 3.83% | 3.13% | 3.17% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.74 |

"This week's uptick in the 30-year mortgage rate ends a nearly two-month streak of declines," Sean Becketti, Freddie Mac's chief economist, said in a press release.

The 15-year fixed-rate mortgage averaged 3.13%, up from last week when it averaged 3.08%. A year ago at this time, the 15-year fixed-rate mortgage averaged 2.76%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.17% this week with an average 0.4 point, up from last week when it averaged 3.13%. A year ago at this time, the five-year adjustable-rate mortgage averaged 2.8%.

"The 10-year Treasury yield continued its upward trend, rising 7 basis points this week. As we expected, the 30-year mortgage rate followed suit, increasing 5 basis points," Becketti said.

"Mortgage rates increased last week to their highest levels in a month as geopolitical concerns surrounding North Korea eased and Hurricane Irma proved to be less destructive than anticipated," Erin Lantz, Zillow's vice president of mortgages, said when that company released its own rate tracker on Tuesday. "This week markets will focus on Wednesday's FOMC statement."