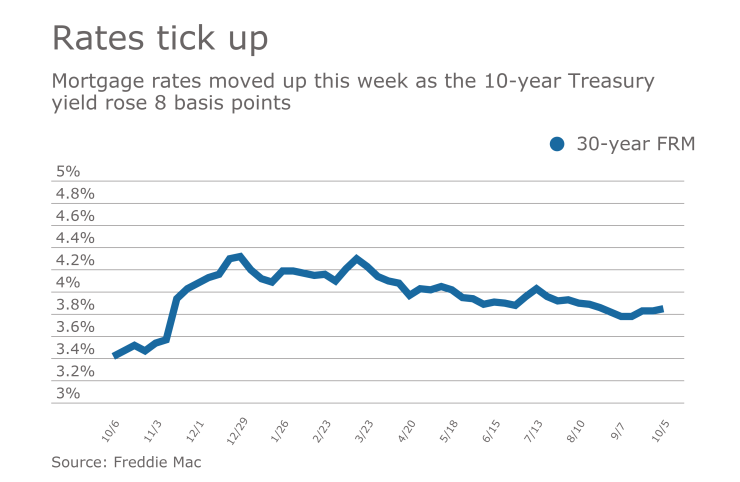

Mortgage rates ticked up to their highest mark in six weeks, reflecting the 20-basis-point rise in the 10-year Treasury yield during September, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.85% | 3.15% | 3.18% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.74 |

The 30-year fixed-rate mortgage averaged 3.85% for the week ending Oct. 5,

"After holding steady last week, rates ticked up this week. The 10-year Treasury yield rose 8 basis points, while the 30-year mortgage rate increased 2 basis points," Sean Becketti, Freddie Mac's chief economist, said in a press release.

The yield on the benchmark 10-year Treasury note ended the month of September at 2.328%, compared with 2.122% at the end of August, capping its biggest one-month gain since last November.

The 15-year fixed-rate mortgage averaged 3.15%, up from last week when it averaged 3.13%. A year ago at this time, the 15-year fixed-rate mortgage averaged 2.72%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.18%, down from last week when it averaged 3.2%. A year ago at this time, the five-year adjustable-rate mortgage averaged 2.8%.

"Mortgage rates increased last week to their highest levels since July due to tax reform proposals that would likely contribute to stronger economic growth in the near term," Erin Lantz, Zillow's vice president of mortgages, said when that company released its own rate tracker on Tuesday.

"Additionally, comments by several Fed officials suggesting a more aggressive pace of interest rate hikes and news of the leading candidates for the next Fed chair contributed to higher rates. Friday's jobs report is the most important economic news on the calendar for this week, though the data are likely to be heavily driven by the effects of Hurricanes Harvey and Irma," Lantz said.