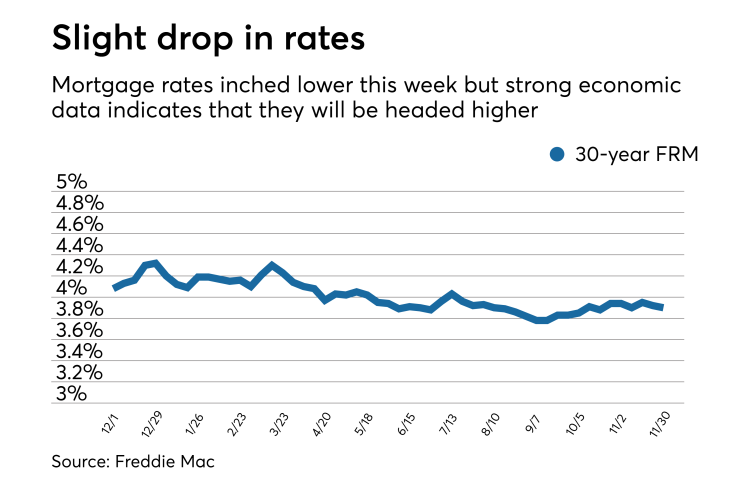

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.90% | 3.30% | 3.32% |

| Fees & Points | 0.5 | 0.5 | 0.3 |

| Margin | N/A | N/A | 2.74 |

The 30-year fixed-rate mortgage averaged 3.9% for the week ending Nov. 30,

"The 30-year fixed mortgage rate fell two basis points to in this week's survey, but we closed our survey prior to a surge in long-term interest rates following an upward revision to third-quarter U.S. Real GDP growth and comments by Federal Reserve Chair Yellen touting a broad-based economic expansion," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release.

"The market implied probability of a Fed rate hike in December neared 100%, helping to drive short-term interest rates higher."

The 15-year fixed-rate mortgage this week averaged 3.3%, down from last week when it averaged 3.32%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.34%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.32% this week with an average 0.3 point, up from last week when it averaged 3.22%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.15%.

"Mortgage rates were flat last week, holding near levels observed for much of the past six months, as lenders and consumers focused primarily on the Thanksgiving holiday," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

"Despite several major economic events — including