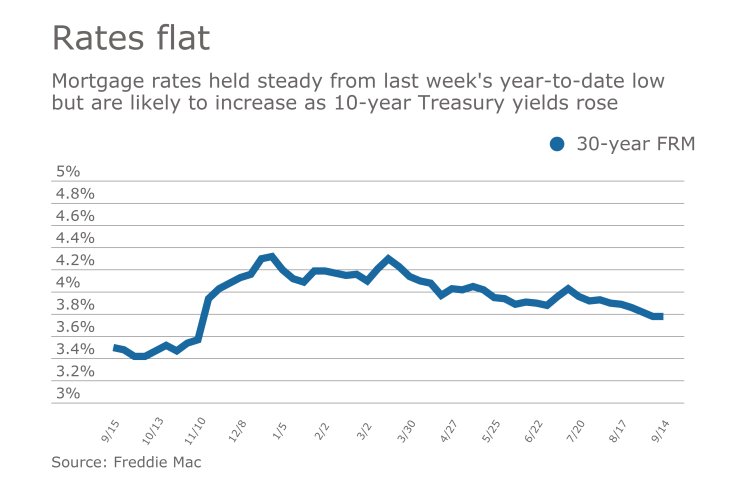

Mortgage rates remained unchanged from last week's year-to-date low but going forward they are likely to increase as 10-year Treasury yields rose.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.78% | 3.08% | 3.13% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.74 |

The 30-year fixed-rate mortgage averaged 3.78% for the week ending Sept. 14, the

"Following a sharp decline last week, the 10-year Treasury yield rose 11 basis points this week. The 30-year mortgage rate, however, remained unchanged at 3.78%. If Treasury yields continue to rise, mortgage rates could see an increase in next week's survey," Sean Becketti, Freddie Mac's chief economist, said in a press release.

The 10-year yield was 2.05% when trading closed on Sept. 8, but when the market resumed on Sept. 11, it opened at 2.09% and closed at 2.13%. On Sept. 13, the yield at closing was 2.19%.

The 15-year fixed-rate mortgage averaged 3.08%, the same as last week. A year ago at this time, the 15-year fixed-rate mortgage averaged 2.77%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.13%, down from last week when it averaged 3.15%. A year ago at this time, the five-year ARM averaged 2.82%.

"Mortgage rates were flat for the second week in a row, holding near their lowest levels since November 2016," Erin Lantz, Zillow's vice president of mortgages, said when that company released its own rate tracker on Tuesday.

"We expect another relatively quiet week, with Thursday’s inflation data being the most important economic news due this week. The data were collected before the gas-price spike during Hurricane Harvey so overall inflation should still appear slow, providing the Fed further motivation to delay future rate hikes," Lantz said.