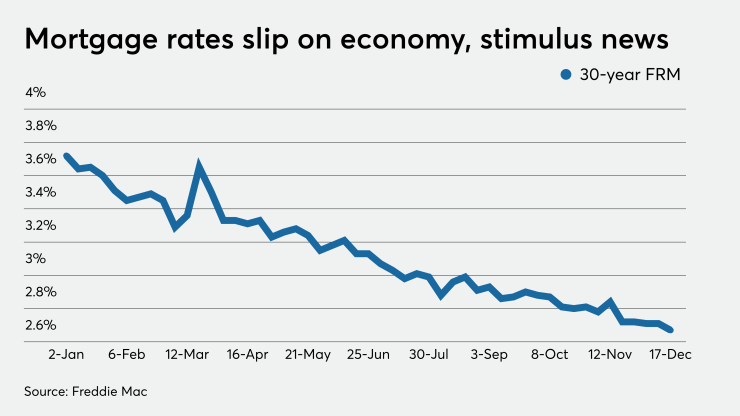

Mortgage rates dropped to yet another new record low over concerns about economic sluggishness and the inability to pass a stimulus package, according to Freddie Mac.

Freddie Mac's Primary Mortgage Market Survey found that the 30-year fixed rate mortgage for the week of Dec. 17 was at 2.67%, down four basis points from 2.71% for

"The housing market continues to surge higher and support an otherwise stagnant economy that has lost momentum in the last couple of months," Sam Khater, Freddie Mac's chief economist, said in a press release. "Mortgage rates are at record lows and pushing many prospective homebuyers off the sidelines and into the market. Homebuyer sentiment is sanguine and purchase demand shows

Mortgage rate movements in recent weeks have been more dependent on fiscal and monetary policy matters — along with coronavirus vaccine news — rather than economic data, Zillow Economist Matthew Speakman said in his commentary on that company's rate tracker.

"Wednesday's statement from the Federal Reserve had the potential to move rates, but bond yields — along with mortgage rates — barely budged after the central bank stated plans to maintain their current pace of bond buying and commitment keeping the federal funds rate low," Speakman said. "On the fiscal policy side, reports are that a new relief deal may be drawing near. A new spending package may place some upward pressure on mortgage rates, particularly if the package contains more than has been reportedly debated."

While the benchmark 10-year Treasury yield fell two basis points between Dec. 9 and Dec. 16 to close at 0.92%, that measurement does not capture the volatility in movements during the period. On Dec. 7, the 10-year yield was as low as 0.873% while its high point was on Dec. 16, the day of the Fed announcement, at 0.953%.

At this time last year, the 30-year FRM was at 3.73%.

The 15-year FRM averaged 2.21%, a drop of 5 basis points from 2.26% a week ago. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.19%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.79% with an average 0.3 point, unchanged from last week. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.36%.

Speakman is expecting mortgage rates to remain around their current levels in the short term.

"Investors have expected the spending package for a while now, meaning it's likely that most of their reaction has already been priced in. Overall, mortgage rates remain very low and are unlikely to shift unless a blockbuster spending package is passed before the end of the year," Speakman said.