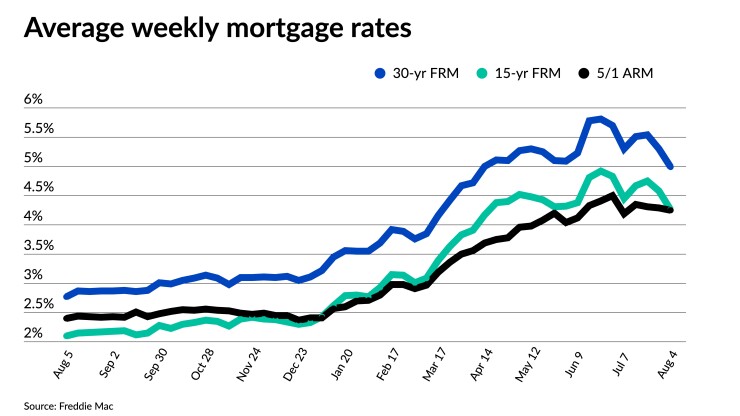

Average mortgage rates dropped under 5% for the first time since mid April over the past week,

The 30-year fixed-rate average fell 31 basis points to 4.99% for the weekly period ending August 4, according to Freddie Mac's Primary Mortgage Market Survey, continuing the trend of steep rises and falls that has seen it fluctuate between 3.22% and 5.81% this year.

"Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth," said Freddie Mac Chief Economist Sam Khater in a press release.

With the announced

"Comments from Federal Reserve Chair Jerome Powell after the meeting were interpreted by many investors as more dovish than prior communications," he said in a research statement.

Various economic indicators pointing to shrinking gross domestic product,

"Investors reacted by driving longer-term rates — such as yields on 10-year Treasuries and mortgage-backed securities — lower, predicting the Fed will have to slow down rate hikes and potentially ease rates sooner than previously expected," Thomas said. Ten-year Treasury movements often correspond closely to mortgage rates.

Although unpredictability has characterized the home lending and housing markets over the past few months, it may become part of "a new normal," according to Robert Heck, vice president of mortgage at online broker Morty. "And it looks very different from the frenzied activity of the past two years," he said in an emailed statement.

Clear signs of

The mortgage industry, therefore, shouldn't be surprised if some volatility persists, Khater said. "The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment."

Alongside the drop in the 30-year average, the 15-year fixed-rate also declined by a sizable margin week over week, falling to 4.26% from 4.58%. A year ago, the 15-year average came in at 2.1%.

The 5-year Treasury-indexed hybrid