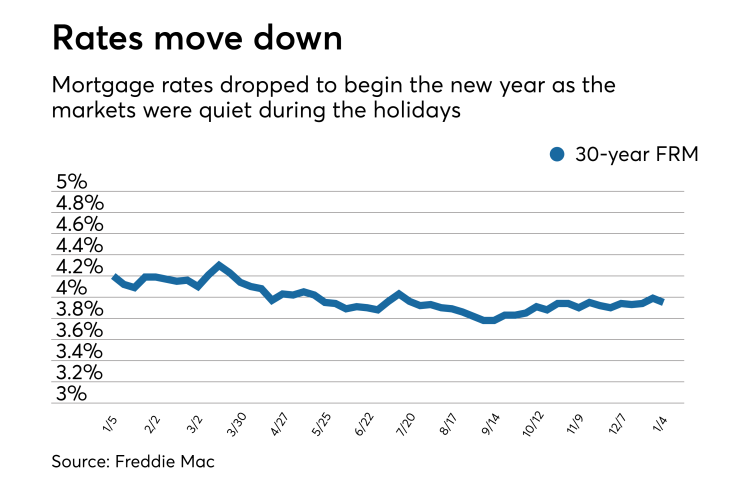

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 3.95% | 3.38% | 3.45% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 3.95% for the week ending Jan. 4,

"Treasury yields fell from a week ago, helping to drive mortgage rates down to start the year. The 30-year fixed-rate mortgage fell 4 basis points from a week ago in the year's first survey," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release.

"Despite increases in short-term interest rates, long-term interest rates remain subdued. The 30-year mortgage rate is down a quarter of a percentage point from where it was a year ago and the spread between the 30-year fixed and 5/1 adjustable-rate mortgage is the lowest since 2009."

The 15-year fixed-rate mortgage this week averaged 3.38%, down from last week when it averaged 3.44%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.44%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.45% this week with an average 0.4 point, down from last week when it averaged 3.47%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.33%.

"Mortgage rates were flat during the holiday-shortened week with markets very quiet between Christmas and New Year's," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

"The relative tranquility of the past two weeks should continue this week, even after Friday's December jobs report. By most expectations, the employment data due Friday should show a strong U.S. labor market and keep expected interest rate hikes on track for the rest of 2018," Terrazas said.