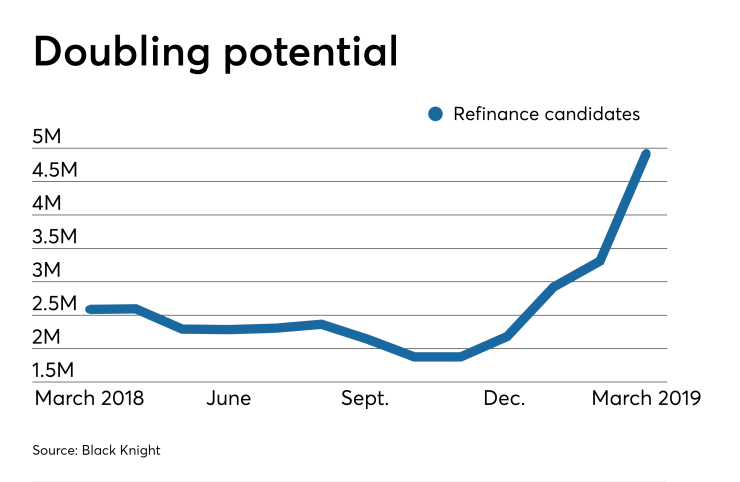

The number of homeowners likely to qualify for a refinance

The plummeting rate is also good news for originations overall as a competitive spring purchase season kicks off.

Though refi incentive is on the rise, the same can't be said for tappable home equity. As house price appreciation cooled, the amount of available equity to homeowners with mortgages (before they reach a maximum 80% combined loan-to-value ratio) dropped for the second straight quarter.

The high of $6.06 trillion in available equity, reached in the second quarter of 2018, dropped by $348 billion in the fourth quarter.

But markets like California, where the average home price fell by $14,600 in the second half of the year, were largely responsible for the drop in equity The Golden State alone accounted for more than 60% of the total tappable equity decline, compared to the majority of the nationwide decline coming from households with over 20% equity in their homes. This suggests the loss can be attributed to a reduction in borrowing power, and is not so much a sign of equity stress on the market, according to Black Knight.