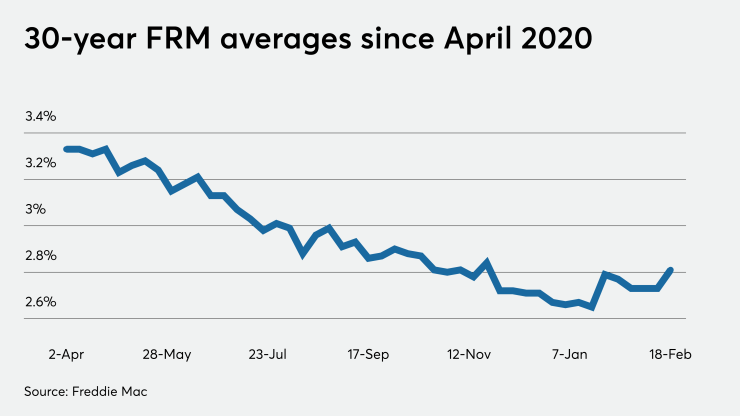

Borrowers holding out for mortgage rates to keep dropping may have missed their chance.

After a two-week holding pattern, mortgage rates finally caught up with the growing Treasury yields and gradual economic recovery driven by the most recent stimulus package.

The 30-year fixed rate mortgage shot up 8 basis points to 2.81% from 2.73%

The

“Investors also appear to be increasingly wary that more fiscal relief and accelerating economic growth through increased vaccination rates could translate to higher inflation,” Speakman said. “That’s something that would reduce the value of bonds’ fixed-payments, and

The average 15-year fixed-rate mortgage also rose, going to 2.21% from 2.19% the week before while falling from 2.99% the same time a year ago. The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.77% with a 0.2 point average, down from 2.79% week-over-week and 3.25% year-over-year.