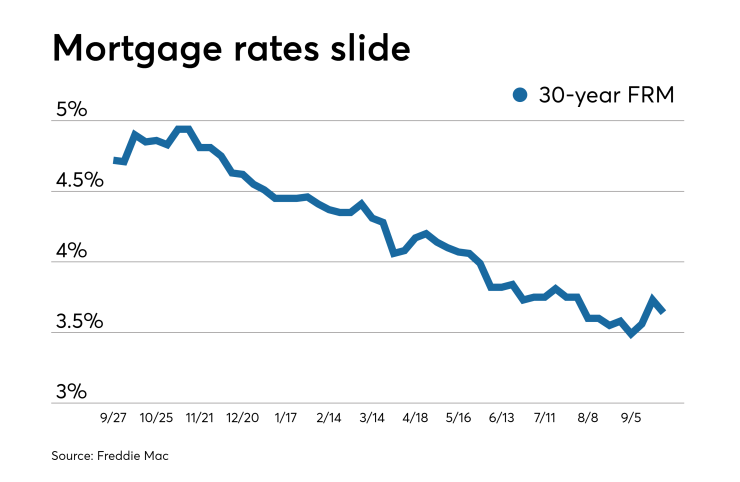

September has been the most volatile month since March when it comes to 30-year conforming mortgage rates, with average weekly movements of 11 basis points up or down, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.64% | 3.16% | 3.38% |

| Fees & Points | 0.6 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.74 |

And this past week was no different when it came to that volatility, as the rate fell 9 basis points from the previous seven day period. That recovered nearly half of the 17 basis points rise the week before that.

Given the headlines over trade battles with China and the House of Representatives initiation of an impeachment inquiry of President Trump, more wide swings in mortgage rates are possible.

"With both the unemployment rate and mortgage rate below 4% and near historic lows, it is no surprise that the housing market regained momentum with home sales and construction at or near decade highs. The fall housing market is poised to continue with steady gains in prices and solid sales activity," Sam Khater, Freddie Mac's chief economist, said in a press release.

The 30-year fixed-rate mortgage averaged 3.64% for the week ending Sept. 26

The 15-year fixed-rate mortgage averaged 3.16%, down from last week when it averaged 3.21%. A year ago at this time, the 15-year fixed-rate mortgage averaged 4.16%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.38% with an average 0.4 point, down from last week when it averaged 3.49%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.97%.

Mortgage rate instability is likely to continue as September ends "as markets digest news surrounding the presidential impeachment proceedings," Matthew Speakman, a Zillow economist, said when that company released its own rate tracker.

"Bond yields initially fell on the news, but later rose after the readout of the president's conversation with President Zelensky of Ukraine was released. A prolonged political battle would likely mean increased volatility for mortgage rates."