Increased refinancing activity that was prompted by a dip in rates drove prepayments higher after four months of record lows in February.

The share of mortgages that prepaid rose to 0.35% from 0.33% in January. Black Knight has been anticipating that some of more recent originations could be exposed to risk due to the recent near-term rate drop. However, the bulk of outstanding mortgages have low rates and are considered unlikely to refinance.

More prepayments could show up in March's report as instability stemming from bank failures has driven rate-related bond yields lower. That trend has

Prepayments, also known as runoff, can be a concern for holders of rights related to monthly mortgage obligations because if a loan securing them gets refinanced the investor losses the cash-flow involved.

But the recent uptick, while notable in that it could mean prepayments have bottomed out for now, is relatively small and less of a concern from a servicing perspective than a possible credit crunch tied to recent bank failures or indication of consumer credit concerns.

Larger concerns for servicing right now are "if there are larger banking system impacts,

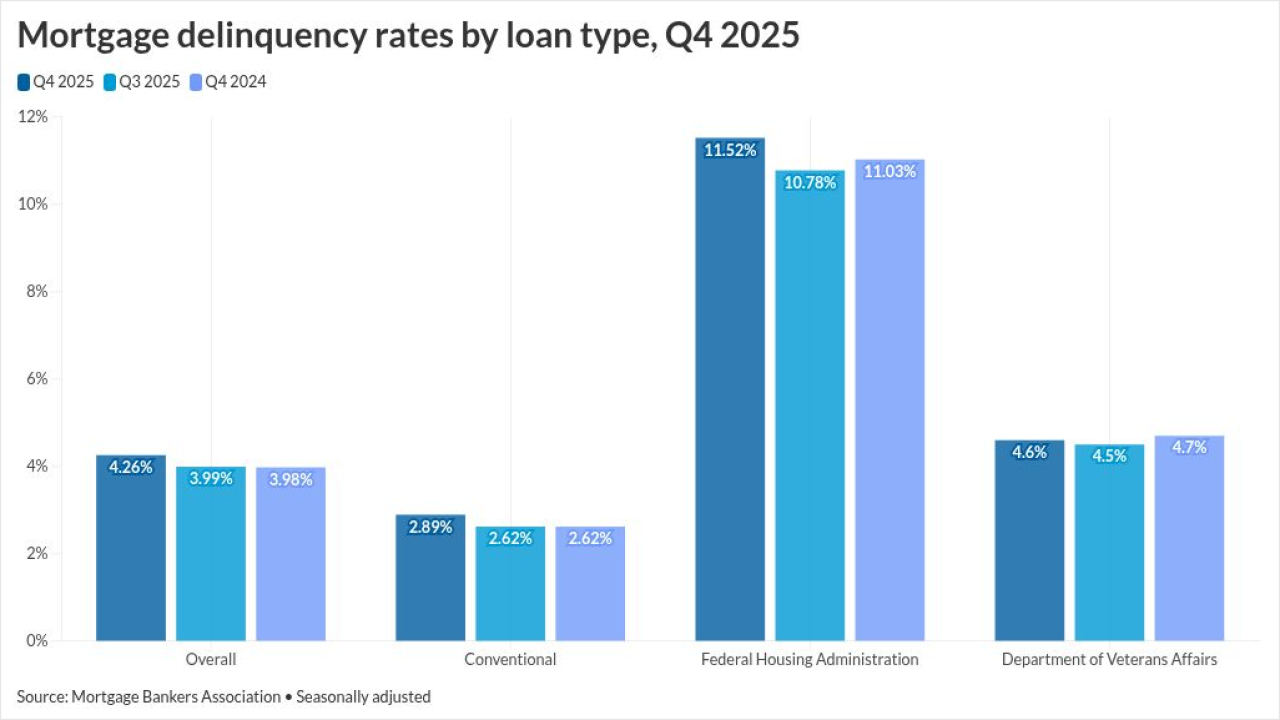

The delinquency rate in February, not including foreclosures, rose after receding the previous month. It increased to 3.45% from 3.38%