Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to a Fannie Mae survey.

"Mortgage origination is complex; it involves many players in the value chain and many processes to transmit large volumes of data among a series of interconnected parties, including consumers, investors, and an array of service providers and stakeholders," Kimberly Johnson, executive vice president and chief operating officer at Fannie Mae, said in a blog.

"Back-end operations are inherently more complicated than the front-end borrower experience. While most lenders cited the implementation of a point-of-sale system as a success example on the front-end, it is more difficult to implement a single solution to transform back-end operations."

A majority of respondents said outcomes for both types of efforts were positive, with 87% stating that updates to the front-end were successful or very successful, and 69% saying the same for the back-end improvements.

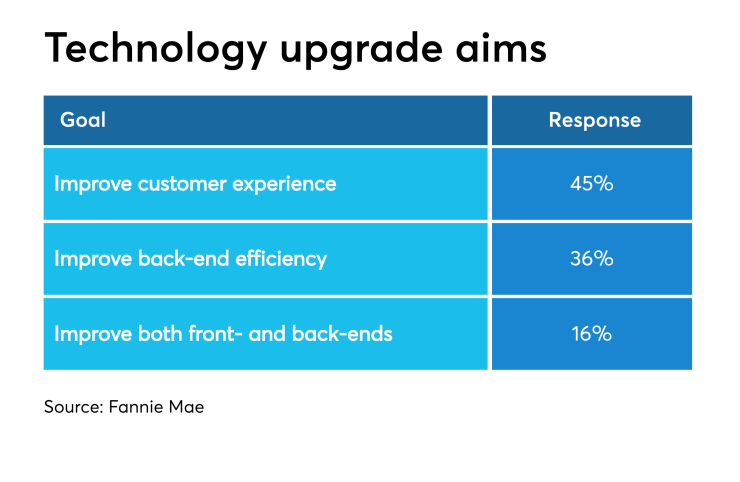

Among the lenders surveyed, 45% leaned toward making

Problems facing lenders looking to

"While it's relatively straightforward to calculate returns on the implementation of a POS system, calculating returns on back-end digital transformation efforts is often more nebulous; and, any returns might stay negative for several years as these efforts generally do not yield immediate cost savings," Johnson said.

Yet, she noted, investing in the back-end to make operations more efficient is important. It keeps mortgage lenders functioning in a changing environment because it eliminates errors and shifts labor from being a fixed cost to a variable one, allowing originators to scale up or down as needed.

When asked about the

These observations were among the findings in Fannie Mae's third-quarter lender sentiment survey. There were 179 lenders participating in the study, 60 of which were large mortgage originators, 45 of which were midsized and 70 of which were smaller. The respondents included 70 mortgage bankers, 72 depositories, 33 credit unions and four others.