Consecutive-month default rates for home loans are increasing, and they could remain higher the next few months, according to data from Standard &Poor's Dow Jones Indices and Experian.

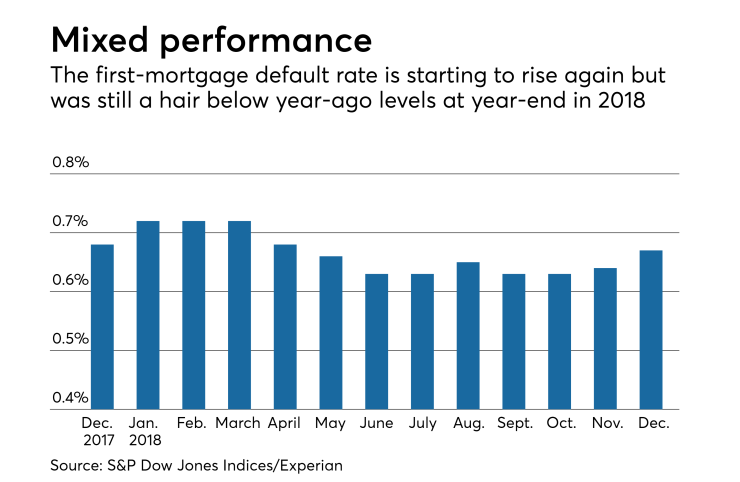

The first-mortgage default rate in December of last year rose by 3 basis points to 0.67% compared to November 2018, leaving it just 1 basis point below what it was in December 2017.

The second-mortgage default rate in December of last year rose by 6 basis points from the previous month to 0.6%, although it was down 62 basis points from a year ago.

The uptick in month-to-month mortgage default rates is part of a larger trend across consumer credit sectors, according to S&P Dow Jones and Experian.

Consecutive-month default rates for all loan types in December 2018 were higher in all major metropolitan statistical areas for the first time since January 2017.

"Consumer credit default rates are giving a caution signal," David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, said in a press release.

The current

However, to date, in most cases default rates and delinquencies have remained lower on a year-to-year basis.

Mortgage delinquencies 30 days or more past due, for example, were a full percentage point lower year-over-year in CoreLogic's latest monthly loan performance report. The 30-day-plus delinquency rate in the most recent month tracked by that report, October 2018, was 4.1%.