A slew of forces worked against the mortgage industry in recent years; technological advancements, shifting demographic forces, heightened competition, and a lack of starter home supply continue to stifle growth and profitability, according to Fannie Mae.

But what hasn't changed is lenders prioritizing

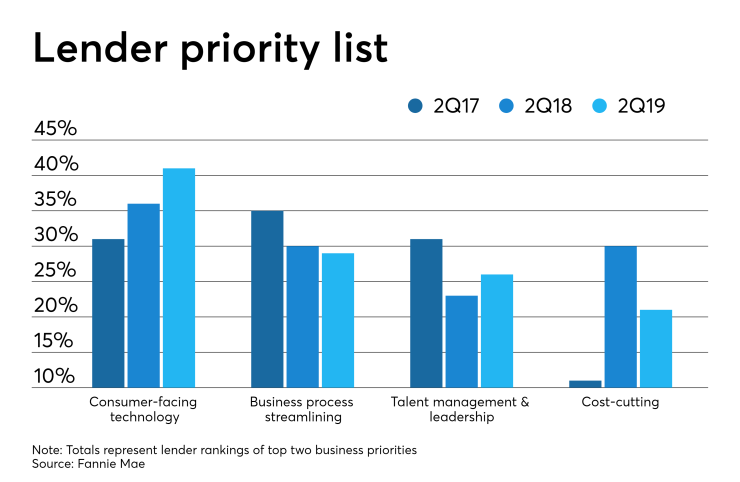

Consumer-facing technology and business process streamlining remained top priorities for lenders over three consecutive years, emphasizing the industry's push for digital. In 2Q19, 41% of lenders cited consumer-facing tech as a top priority, followed by 29% tapping business process streamlining as most important.

Efforts to take on take on tech increasingly trumped cost-cutting as a priority by almost double in the second quarter. Only 21% of lenders named shaving finances as most important for business, even at a time of lagging activity. Ahead of this on the lender priority list was talent management and leadership, with a 26% share.

The findings highlight the importance of digital investments, presumably because tech can support the array of challenges plaguing the market: Digital tools can help reach and attract more borrowers in a down market, they'll speed up processing times and they can support lower costs by saving money spent on paper, mailings and human labor.

The assessment by lenders to prioritize tech falls in line with their views on market threats; the majority believe online business-to-consumer lenders will be their biggest

"Lenders believe that their biggest opportunity lies in re-engineering their processes to be competitive in similar ways. The extent to which this type of simple digital banking model can be operationalized within a complex mortgage ecosystem remains to be seen, but investments to that end continue to be made," said a Fannie Mae blog authored by Andrew Peters, vice president of single-family strategy and insights.