Editor's Note: This is part one of a five-part series on the strategies lenders are using to make their operations more efficient and profitable. Read

The seasonally-weak first quarter is here, adding to the extraordinary number of cost challenges facing mortgage lenders following a year of lower volumes and higher rates.

Lenders produced about $1.7 trillion in home loans in 2017, following a year when volume was above $2 trillion, according to the Mortgage Bankers Association.

What's more, purchase lending accounted for more than 60% of mortgage volume throughout most of 2017, following several years when refinance lending dominated the market. And that pickup in purchase mortgages, which cost more to originate, poses unique challenges for lenders trying to reduce overhead.

And for the first time since 2014, the average interest on a 30-year fixed-rate mortgage hovered above 4% more often than it was below that mark during 2017, according to Freddie Mac.

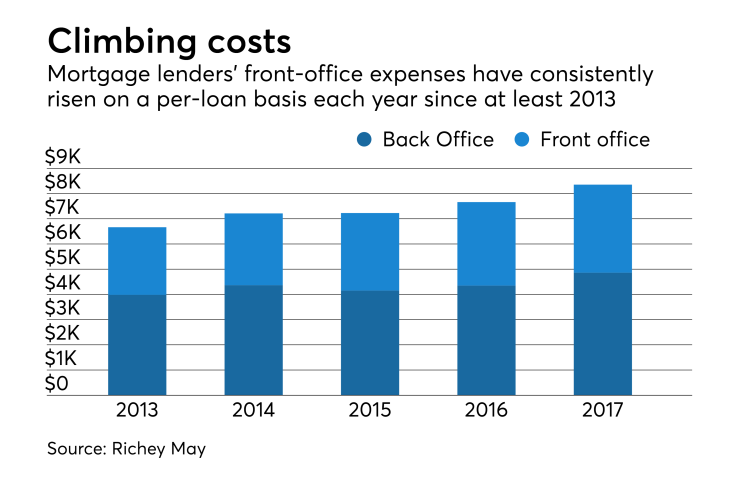

Meanwhile,

Banker and broker

Just a few years ago, it cost lenders about

Lenders are naturally concerned that costs are spiraling out of control, and many are pursuing aggressive strategies to better manage the situation.

That's easier said than done.

Amid fierce competition for both volume and talent, mortgage companies can't afford to not to invest in the strongest loan officers and back office capabilities available. That means lenders can't just make cuts across the board. Instead, lenders are reducing expenses, as well as making investments in tools and processes that improve efficiency across every facet of their organization.

Underlying each of these strategies are new approaches to analyzing a variety of performance metrics and using that data to improve efficiency, often by introducing new technology or finding new uses for existing systems.

The most important area of focus is compensation, which represents the lion's share of expenditures. But lenders are also scouring other line items on the budget, including marketing; facilities and equipment; cost of funds; and yes, even compliance, to streamline operations and remain competitive.

Fierce competition for sales talent makes compensation tough to cut. But personnel costs make up the bulk of expenses and must be a target for cost controls.

Compensation makes up almost 80% of the $8,354 mortgage bankers spend on average to produce a loan, split about evenly between front office and back office personnel, according to Richey May estimates.

"It just seems to take more hands to get loans funded and closed," said Tyler House, manager of advisory services at Richey May.

Unfortunately, there aren't a lot of ways to make cuts without hurting sales.

"Most of the cost frankly is in the early stages of the loan, which is what happens up to and including getting the application originated. So it's going to be very difficult to wring a lot of costs out without focusing on sales and marketing," said Garth Graham, a senior partner at industry consulting firm Stratmor Group.

"It just seems to take more hands to get loans funded and closed."

— Tyler House, manager of advisory services, Richey May

Performance data analyzed by Stratmor shows the top 40% of mortgage sales staffs are responsible for the majority of production volume, suggesting lenders could cut as much as 60% of their loan officers. But doing so puts lenders at risk of being understaffed in times of increased demand or when a top performer is recruited by a rival lender in today's competitive hiring environment.

Alternatives include straining the capacity of existing resources, but that reaches a point where it has diminishing productivity returns. It also can drive top producers to competitors if the working conditions are better. New trainees help, but require time and money.

What lenders really want is a strategy that allows them to downsize operations without hurting sales.

Movement Mortgage inadvertently found one.

The idea originated with Geoff Brown, a loan officer who made an off-hand remark at a holiday party a couple years ago about how he no longer knew the members of the operations center support staff he worked with as well as he used to because there were so many.

Executive Vice President Toby Harris took note, and thereafter charged Chief Operations Officer John Third with reorganizing the few hundred people in each of the company's three large operations centers into smaller teams offering dedicated support to sales in different regions.

While the move wasn't originally designed to reduce staff size, the reorganization of the support teams helped sales. The teams made it easier to track performance, offer supplemental training to underperformers and make cuts when that training failed.

And after analyzing the outcome over time, the company recently found that it did result in a reduction in its headcount. The first full year the company put the strategy into effect, it was able to originate $1 billion more annually with a support staff that was 10% smaller, primarily due to attrition.

"It really had an immediate impact on improving the relationships between ops and sales, and a side effect it had was to improve productivity, therefore reducing some of the costs per loan," said Third.