Editor's Note: This is part two of a five-part series on the strategies lenders are using to make their operations more efficient and profitable. Read

The cost-control strategy that gets the most buzz today involves pairing automation aimed at

Call center staff get paid less, but also don't usually generate leads to loans the way traditional loan officers do, particularly when it comes to

That means lenders need to add leads or other marketing expenses to the cost of operating a consumer-direct call center before calculating any savings from it.

Per-loan lead costs range from an estimated $800 to $1,200 per loan, according to Tyler House, manager of advisory services at Richey May.

The cost savings for a consumer-direct channel compared to a distributed retail channel can be "almost negated fully by the marketing costs that the call center has to go through," said House.

"That lead cost will eat you alive," added Stratmor Group Senior Partner Garth Graham.

A consumer-direct strategy can produce cost savings in the purchase market, but the margins may be thinner because the product type requires dedicated loan officers to be effective, Graham said.

Pairing consumer-direct strategies with a servicing portfolio or other internal marketing can help lenders keep marketing costs under control, said Arrive Home Mortgage President Dan Cutaia, an industry operations veteran who is selling

"The call center is clearly more cost effective if you have a servicing portfolio and are not paying these third party lead aggregators or advertisers," said Cutaia.

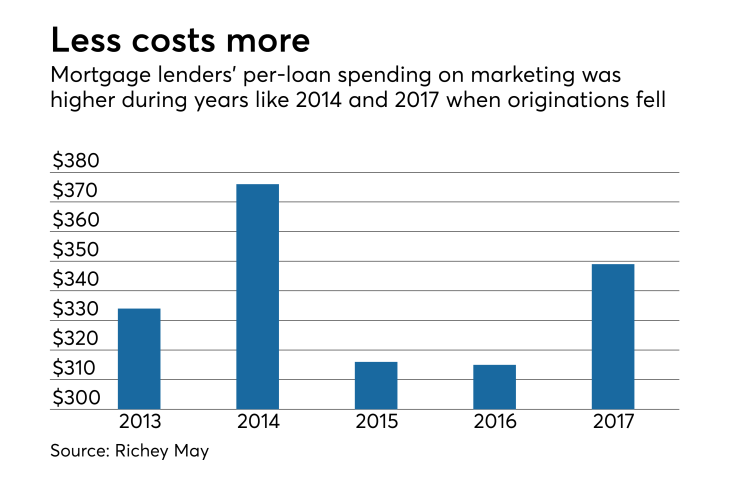

Traditional marketing costs for lenders are more manageable when companies don't need to purchase online leads, which average $349 per loan, according to Richey May.

Other ways companies are looking to control marketing costs and ensure loan officers use marketing tools is to have them pitch in financially.

"You ought to parlay every lead into broader referrals with all the parties involved."

— Matt Clarke, chief financial officer, Churchill Mortgage

Churchill Mortgage, which is looking to cut loan costs 15% in the coming year, offers some customer relationship management tools to its staff without obligation. But the lender will ask loan officers to pay for a real estate information system that helps them market to homeowners if they're not using it.

The company analyzes the per-loan cost of marketing carefully and has found Google's pay-per-click advertising is among the most efficient and effective sources of leads. However, this type of marketing does require an investment of time to understand the science of how search engines work.

Additionally, Churchill works to make sure marketing is cost effective by maximizing the use of any lead as a source of future business not just from the borrower but the real estate agent or other referral source the borrower works with.

"You ought to parlay every lead into broader referrals with all the parties involved," said Matt Clarke, Churchill's chief financial officer and chief operations officer.