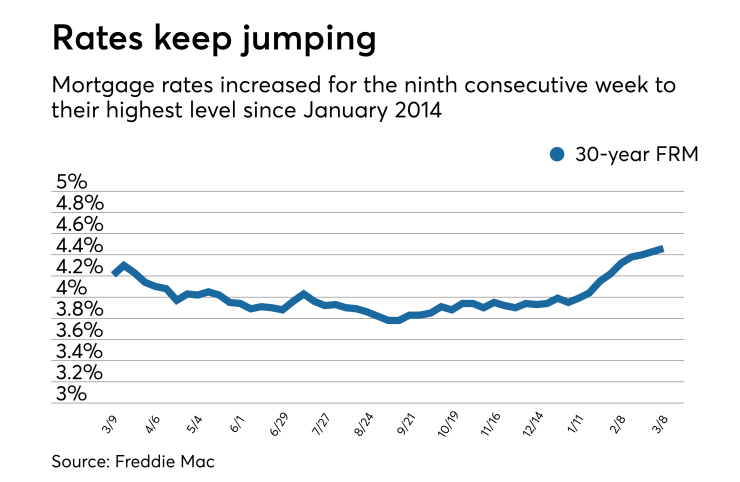

Mortgage rates increased for the ninth consecutive week, moving in reaction to bond and stock market volatility.

| 30-Year FRM | 15-Year ARM | 5/1-Year ARM | |

| Average Rates | 4.46% | 3.94% | 3.63% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.46% for the week ending March 8, according to Freddie Mac. This was

"The 10-year Treasury yield has been bouncing around in a narrow 15-basis-point range for the last month. While the yield on the 10-year Treasury is currently below the high of 2.95% reached two weeks ago, mortgage rates are up for the ninth consecutive week. The U.S. weekly average 30-year fixed mortgage rate rose 3 basis points in this week's survey, its highest level since January 2014," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release.

The 15-year fixed-rate mortgage this week averaged 3.94%, up from last week when it averaged 3.9%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.42%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.63% this week with an average 0.4 point, up from last week when it averaged 3.62%. A year ago at this time, the five-year ARM averaged 3.23%.

"Mortgage rates eased last Thursday after Federal Reserve Chair Jerome Powell appeared to soften earlier statements about his expectations for interest rates this year, but moved higher as geopolitical uncertainty seized the headlines," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

"Markets could be particularly volatile over the next couple of days as the tenor of U.S. economic and trade policy gets worked out, but eyes will still be watching Friday’s jobs report, although to a lesser extent," Terrazas said.