The Mortgage Bankers Association's February forecast updated its purchase origination and interest rate expectations, but cautioned that the world events could throw things off.

Mortgage rates are now expected to reach 4.3% by the end of this year and 4.5% in 2023, up from 4% and 4.3% in

"And obviously, as many of you and I was just trying to figure this out this morning, we have

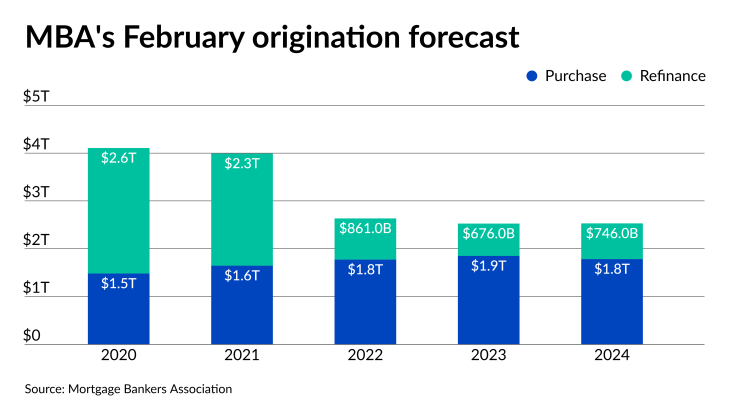

But even with the MBA raising its interest rate forecast, it still boosted its purchase mortgage and total mortgage volume outlook for 2022 compared with its January predictions, by $34 billion to $1.73 trillion and $2.63 trillion respectively. The organization pegged 2021's total volume at $3.99 trillion, with $1.65 trillion from purchase.

And while the rate increase through the next two years does seem gradual, "there is going to be a lot of volatility between now and 2023," based on past experience, Kan said.

The MBA is predicting the Federal Reserve will

Kan also compared the Fed's expectations of reducing its mortgage-backed securities and Treasury note holdings to the rise in Treasury yields and thus mortgage rates in 2013, when

"I think now the communication has been a little bit clearer," Kan said. "Markets have been, in some ways, a little bit more prepared than they were in 2013."

But still, mortgage rates are likely to quickly increase as things tighten, he continued.

As the mortgage business shifts to a purchase market,

But that low point came during a purchase market year, she noted.

"Especially as we're entering a purchase market, whoever can figure this out, good for them because it's been really tough," Walsh declared.

The best year for retention in recent times was 2012, when it was at a 36% rate, but Walsh dismissed that because many of the new loans created were a result of the crisis-era

In the current market, "we're at the point where there's not a lot of customer loyalty. So how do we build that? I don't have the solution," Walsh said.

But she did note an opportunity to improve customer retention efforts: consumer-servicer touch points are increasing. In 2020, that was at an average of 18.9 total touches, similar to the pre-pandemic year of 2019 at 18.8 and well above 2016's 13.1; that was the third best year since 2008, according to the MBA's data.