Following six weeks of incremental declines and two months of general downtrends, coronavirus-related forborne mortgages rose this week, according to Black Knight.

As of Sept. 29, about 3.618 million borrowers sat in active plans, up by 21,000 from the previous week's 3.597 million. Still, more than 1 million fewer consumers are in forbearance plans since

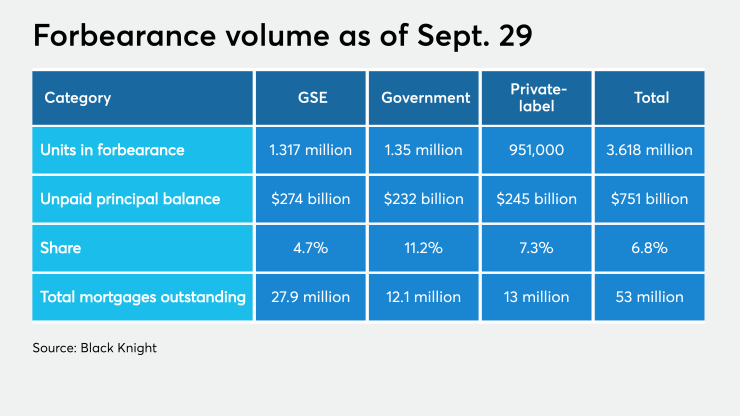

The 3.618 million outstanding loans represent 6.8% of all active mortgages, with a combined unpaid principal balance of $751 billion. Those figures came down from May 26's high-water marks of 9% and $1.05 trillion.

Portfolio and private-label securitized loans led the weekly uptick, adding 28,000 mortgages to a total of 951,000 in forbearance plans. Borrowers

Active forbearances held by government-sponsored enterprises fell by 9,000 from the week prior to 1.317 million, offsetting some of the overall growth.

The latest Black Knight estimates show mortgage servicers will need monthly advances of $4.4 billion in principal and interest payments and $1.6 billion due in taxes and insurance. Those break down to $1.5 billion and $600 million for Fannie Mae and Freddie Mac mortgages, $1.2 billion and $500 million for FHA and VA, and $1.6 billion and $500 million for private-label.

"With more than a million forbearance plans for which September's mortgage payment was the last payment covered under forbearance plan — and another million set to expire in October — significant removal/extension activity is still likely over the next few weeks," company representatives wrote in an accompanying blog post. "The ongoing COVID-19 pandemic continues to represent significant uncertainty for the weeks ahead."

Approximately one in five homeowners missed or deferred a mortgage payment while one in three renters missed a rental payment in 2020,

Only 16% of homeowners and 15% of renters caught up on those back payments they missed. Of the homeowners who deferred their monthly dues, 46% missed three or more payments since March. Those deferred payments piled up to at least $2,000 for 46% of late borrowers and at least $5,000 for 18%.

Overall, 61% of consumers said their emergency savings either won't last through the end of the year or it's already run out.