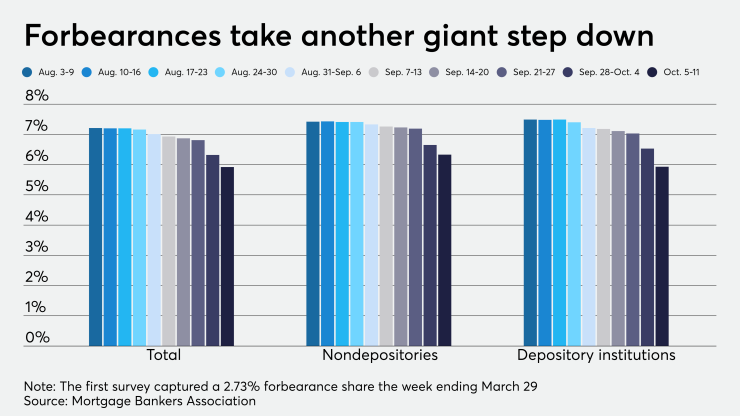

The rate of mortgages entering coronavirus-related forbearance saw another massive drop, falling 40 basis points between Oct. 5 and 11, according to the Mortgage Bankers Association.

It followed a 49-point decrease

As with the large decrease the week before, the rate’s decline from Oct. 5 and 11 is largely attributed to the expiration of

Forbearance rates fell for every loan type. The share of conforming mortgages — those purchased by Fannie Mae and Freddie Mac — declined for the 19thconsecutive week to 3.77% from 4.03%. Ginnie Mae loans —

"The steady improvement for Fannie Mae and Freddie Mac loans highlights the improvement in some segments of the job market and broader economy," Mike Fratantoni, MBA’s senior vice president and chief economist, said in a press release. "The slower decline

Private-label securities and portfolio loans in forbearance — products not addressed by the coronavirus relief act — plummeted to 8.86% from 10.06%.

A 26.32% share of all forborne mortgages sit in the initial forbearance stage, 72.08% shifted to extended plans, with the remaining 1.6% are re-entering forbearance after a previous exit.

Forbearance requests as a percentage of servicing portfolio volume inched down to 0.1% from 0.11%, while call center volume as a percentage of portfolio volume went to 8.2% from 8.8%.

The MBA's sample for this week's survey includes a total of 51 servicers with 26 independent mortgage bankers and 23 depositories. The sample also included two subservicers. By unit count, the respondents represented about 75%, or 37.3 million, of outstanding first-lien mortgages.