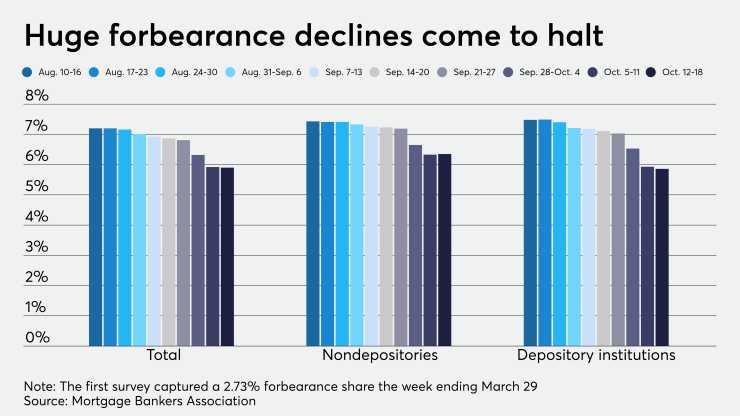

After back-to-back weeks of steep declines, mortgages entering coronavirus-related forbearance only inched down 2 basis points between Oct. 12 and 18, according to the Mortgage Bankers Association.

It followed a decrease of

Borrowers falling outside the six-month

Overall, the lopsided improvement in the number of forbearances is reflective of the broader economy's pace of recovery.

"There continues to be a steady improvement for Fannie Mae and Freddie Mac loans, but the forbearance share for Ginnie Mae, portfolio, and PLS loans all increased," Mike Fratantoni, the MBA's senior vice president and chief economist, said in a press release. "This is further evidence of the unevenness in the current economic recovery. The housing market is booming, as shown by the extremely strong pace of home sales last week. However, many homeowners continue to struggle, as the pace of the job market’s improvement has waned."

The share of conforming mortgages — those purchased by Fannie Mae and Freddie Mac — dropped for the 20thconsecutive week to 3.72% from 3.77%. Ginnie Mae loans —

Private-label securities and portfolio loans in forbearance — products not addressed by the coronavirus relief act — also grew, going to 8.9% from 8.86%.

A 25.02% share of all forborne mortgages sit in the initial forbearance stage while 73.14% shifted to extended plans and the remaining 1.84% re-entered forbearance after exiting previously.

Forbearance requests as a percentage of servicing portfolio volume shifted back up to 0.11% from 0.1%, while call center volume as a percentage of portfolio volume rose to 8.9% from 8.2%.

The MBA's sample for this week's survey includes a total of 51 servicers with 26 independent mortgage bankers and 23 depositories. The sample also included two subservicers. By unit count, the respondents represented about 75%, or 37.3 million, of outstanding first-lien mortgages.