Mortgages in forbearance rose after two weeks of declines, following the trend of midmonth increases in active plans and the country’s surging coronavirus cases, according to Black Knight.

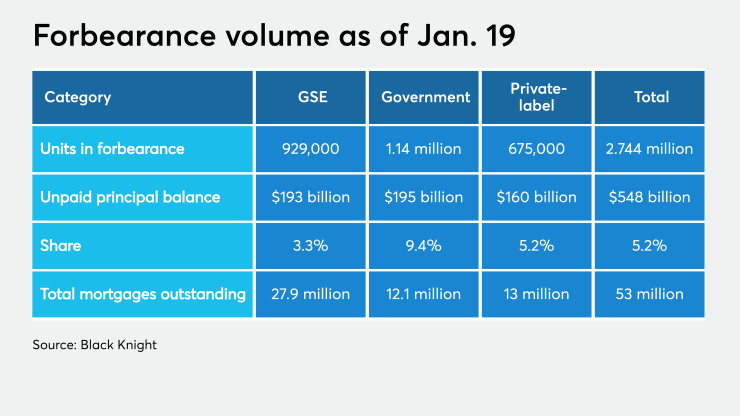

Forbearances jumped by 17,000 from one week earlier, growing to a total of 2.744 million plans as of Jan. 19. This forborne faction represents 5.2% of all mortgages and a combined unpaid principal balance of $548 billion, both up from 5.1% and $545 billion.

Loans backed by Fannie Mae and Freddie Mac were the only loan type to decrease week-over-week, dipping by 3,000 to a total of 929,000. Government-backed mortgages — backed by the FHA and VA — rose by 5,000 to 1.14 million overall. Portfolio and private-label securitized loans — which do not fall under

“Removal rates have also slowed noticeably following the six-month point of forbearance plans,” Andy Walden, Black Knight economist and director of market research, said in the report. “This suggests that those

Mortgage