Record-low interest rates, high origination volumes and social distancing created a perfect storm for mortgage fintechs to thrive over the last several months and their success has invited a wave of investment from venture capitalists.

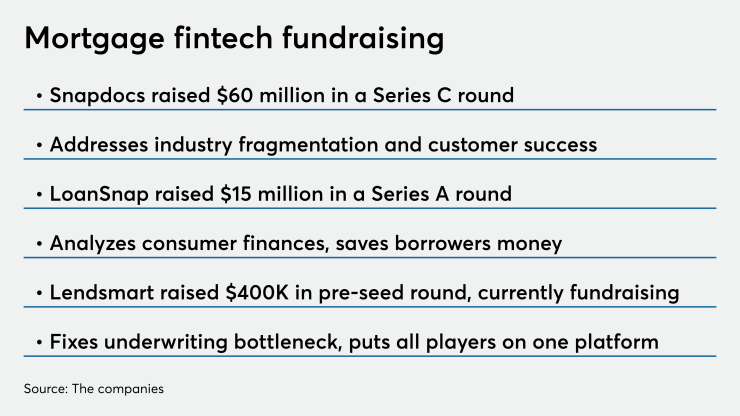

Snapdocs — a cloud-based platform connecting lending parties for digital closings — on Monday announced that it raised $60 million in a Series C round after pulling $25 million less than a year ago. In addition to Sequoia Capital, F-Prime Capital, Founders Fund, Lachy Groom and DocuSign, Y Combinator led the round, contributing over half of the funding and putting partner Anu Hariharan on the board of directors.

"It's a huge market opportunity. I personally find the mortgage closing process so cumbersome. The cost to close is like $6,000 to $7,000 and it always bothered me that none of that was online. It took 30 or 60 days and it was a black box," Hariharan said in an interview. "Snapdocs is at a point where enough stakeholders — large portions of notaries, settlement agents and lenders — are lining up so that you can truly automate the full closing process. There are a lot of people approaching it from the real estate agent side. But I really think the closing process needs to be automated from the stakeholders downstream."

Since inception, Snapdocs aimed to bring

In early October, LoanSnap — whose automated loan process

While these investments may seem like a recent trend, it's the consummation of years of work in the making.

The reason

AK Patel, founder and CEO of Lendsmart, noted that investment is coming from those who see remote transactions as the new normal, with or without social distancing measures. The company raised a pre-seed round of $400,000 at the beginning of 2020 to cover infrastructure costs and is actively fundraising a $2 million seed round with venture capital firms to build out its platform.

"We talked to banks in January who didn't want to adopt a digital solution because they were all about handshakes and in-person relationships," Patel said. "Post-COVID, those same banks weren't able to process any loans or do any signatures. Mortgages and home buying are 100% going to be online. There shouldn’t be any true need for any borrower to go into a branch to close on a loan."

Lendsmart wants to resolve bottleneck issues in underwriting and communication. Using artificial intelligence to predict underwriting questions, while also instantly verifying assets, income and employment, it aims to bring loan closing down to two weeks. Its business model is an inverse one-stop shop, not providing all the parties within the homebuying and lending processes themselves, but placing them at the borrower's fingertips.

"The purpose of our platform is for the borrower never to leave. There's no need for them to ever open up a new tab, to Google home insurance or the best attorney in their ZIP code. We do that."