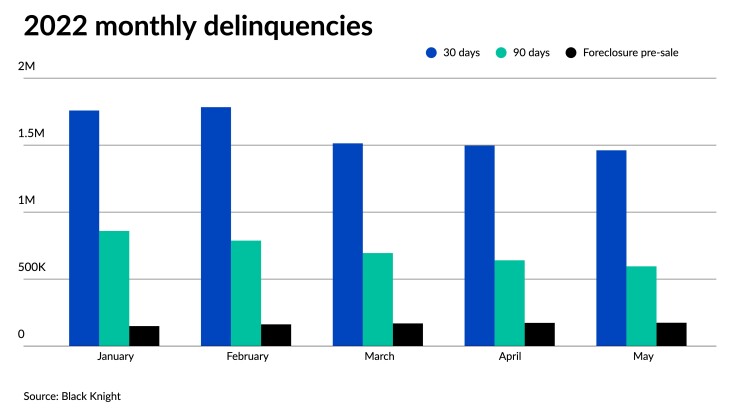

The mortgage delinquency rate fell to another record in May, while a drop-off in foreclosure starts also pointed to continued improvement in the number of seriously distressed borrowers in the U.S.

According to mortgage technology and data provider Black Knight, the rate of delinquencies dropped to 2.75% of all outstanding mortgages last month, down from 2.8%

Serious delinquencies, defined as loans where payments are more than 90 days past due but not yet in foreclosure, dropped by an even larger 7% month over month to 595,000 from 640,000, but are still 45% higher than their pre-pandemic total.

Meanwhile, foreclosure starts in May also came in 12% lower than in April, falling to 18,800 from 21,400, well below pre-pandemic levels. However, properties in pre-sale foreclosure inventory saw a small uptick to 174,000 from 173,000 month over month.

The improvement in delinquencies and foreclosure starts, particularly in comparison to their levels the onset of the COVID pandemic, supports a possible trend other

Earlier this week, the Mortgage Bankers Association also released May data and similarly found the percentage of non-current borrowers falling among the servicers it monitored. Homeowners in COVID-related forbearance plans has also dwindled to just 0.85% of all servicing volume following the expiration of borrower-relief protections introduced at the start of the coronavirus pandemic, but they are not becoming delinquent.

“Most borrowers exiting forbearance are moving into either a loan modification, payment deferral or a combination of the two workout options,” said Marina Walsh, MBA’s vice president of industry analysis, in a press release.

But Walsh also noted the

While overall delinquency numbers hit another record low, borrowers who missed a single payment increased by 0.2% on a monthly basis, Black Knight said, attributing the uptick to seasonal patterns.

The states with the highest share of borrowers not current in their mortgage payments for at least 30 days were concentrated in areas hit by their share of natural disasters over the past year. Approximately 6.1% of borrowers in Mississippi were behind on payments, while Louisiana had a non-current share of 5.4%. Alabama and Oklahoma followed at 4.5% each, and West Virginia rounded out the top five at 4.2%.